Right To Cancel Refinance

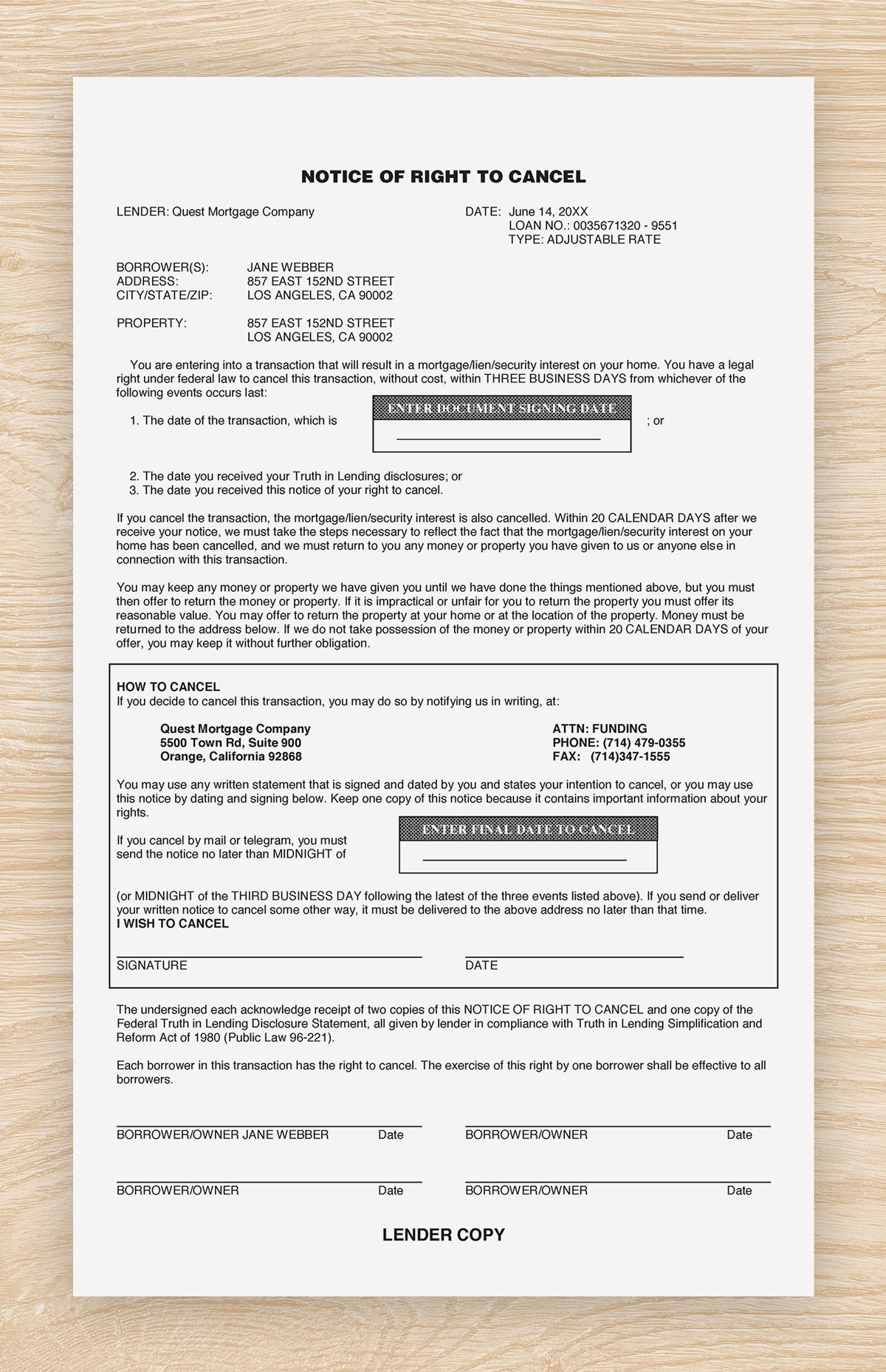

The seller must also provide you with a cancellation form that you can use. Examples of loans that include a Notice of Right to Cancel form include refinance loans in which the borrower is changing lenders.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

This is referred to as your cooling off period and the duration of this period depends on what you bought and the manner in which you bought it.

Right to cancel refinance. Under the Consumer Credit Act you have 14 days to withdraw. However there are exceptions and qualifications to the right to cancel some of which are noted below. You have a legal right under Federal law to cancel this transaction without cost until midnight of the third business day after whichever of the following events occurs last.

Through the right of rescission the transaction is canceled with no questions asked and the lender must relinquish its claim to the property and refund all fees within 20 days of the right. If you have the right to cancel the seller must give you written notice of your right. You have received a Closing Disclosure form or a Truth.

You have the right to cancel a credit agreement if its covered by the Consumer Credit Act 1974. The consumer may modify or waive the right to rescind if the consumer determines that the extension of credit is needed to meet a bona fide personal financial emergency. If you cancel a refinance before the closing you should expect the application fee to be nonrefundable.

E Consumers waiver of right to rescind. But under certain circumstances you are given the right to cancel over a specific period of time. If you are refinancing a mortgage you have until midnight of the third business day after the transaction to rescind cancel the mortgage contract.

Your Right to Cancel You are entering into a transaction that will result in a mortgage on your home. It gives individuals the option to cancel certain residential loans within. This must be included in the contract otherwise the seller cant enforce the contract against you.

You have signed the credit contract also known as the Promissory Note. If you are refinancing a mortgage and you want to rescind cancel your mortgage contract. The right of rescission refers to the right of a consumer to cancel certain types of loans.

When you take out a loan or get credit for goods or services you enter into a credit agreement. If youre refinancing your mortgage and decide you want to cancel or rescind the contract your 3-day right of rescission period will begin once the following events occur. To modify or waive the right the consumer shall give the creditor a dated written statement that describes the emergency specifically modifies or waives the right to rescind.

A loan secured by an interest in the borrowers principal residence including a mortgage refinance except the right to cancel does not apply to the following types of mortgage loans. Thanks to a specific right outlined in the Truth in Lending Act known as the Right of Rescission borrowers are able to cancel a refinance home equity loan or HELOC transaction within three days of closing the loan. Youre allowed to cancel within 14 days - this is often called a cooling off period.

The right to rescind is essentially the right to cancel the mortgage transaction and have any fees refunded if they arent happy with the loan for any reason. The right of rescission allows a borrower to cancel a home equity loan a line of credit or a refinance of an existing mortgage within three business days. If you decide to cancel you should complete and return it to the seller.

If a homeowner decides to refinance their mortgage once loan documents are signed they will have the right to rescind the transaction for a period of three business days. Loans Secured by Borrowers Residence. 1 the date of closing of the transaction 2 the date you received your Truth in Lending disclosure 3 the.

In a refinancing or consolidation by the original creditor of an extension of credit already secured by the consumers principal dwelling the right of rescission shall apply however to the extent the new amount financed exceeds the sum of 1 the unpaid principal balance plus 2 any earned unpaid finance charge on the existing debt plus 3 any amounts attributed solely to the costs. Also keep evidence that it has been sent like a. Home equity loans and lines of credit and cash-out refinance loans loans for more than the current loan balance and taking the difference in cash with a different lender.

Find out how to cancel a contract without being penalised. The right of rescission is a consumer protection provided by the federal Truth in Lending Act also known as Regulation Z.

What Is The Notice Of Right To Cancel In The Escrow Process Cv Escrow

What Is The Notice Of Right To Cancel In The Escrow Process Cv Escrow

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Notary Signing Agent Document Faq Notice Of Right To Cancel Nna

Notary Signing Agent Document Faq Notice Of Right To Cancel Nna

12 Cfr Part 226 Appendix H Title 12 Banks And Banking Appendix H To Part 226 Closed End Model Forms And Clauses

Notary Signing Agent Document Faq Notice Of Right To Cancel Nna

Notary Signing Agent Document Faq Notice Of Right To Cancel Nna

Right Of Rescission The Truth About Mortgage

Right Of Rescission The Truth About Mortgage

Refinancing Understanding Your Right To Cancel Cv Escrow

Refinancing Understanding Your Right To Cancel Cv Escrow

Https Www Federalreserve Gov Newsevents Press Bcreg Bcreg20100816 Form H 8 A Pdf

How The Right Of Rescission For A Refinance Works Freeandclear

How The Right Of Rescission For A Refinance Works Freeandclear

Simple Real Estate Definitions Right To Cancel Benchmark Realty Llc

Https Files Consumerfinance Gov F 201410 Right To Cancel Explainer Pdf

How The Right Of Rescission For A Refinance Works Freeandclear

How The Right Of Rescission For A Refinance Works Freeandclear

Cancelling Your Mortgage Loan Zillow

Cancelling Your Mortgage Loan Zillow

Comments

Post a Comment