How To Negotiate A Refinance Mortgage

Do the math to see if refinancing will pay off. But you need to look at your financial situation and loan before you dive in to.

How To Negotiate The Best Rate For Your Commercial Mortgage Refinance Raisal

How To Negotiate The Best Rate For Your Commercial Mortgage Refinance Raisal

The principal challenge is to generate the stable income stream he would need to qualify for a mortgage.

How to negotiate a refinance mortgage. Understanding the Pros Cons of Debt Settlement Services. As far as the settlement time is concerned you can contact your collection agency and negotiate with them. For many borrowers refinancing is a sure-fire strategy to start saving money and paying less for your mortgage.

Just because your brother-in-law got a really low rate 3 months ago you may not be so lucky. Be prepared to walk. Before applying for a refi make sure you understand the costs associated with a new loan.

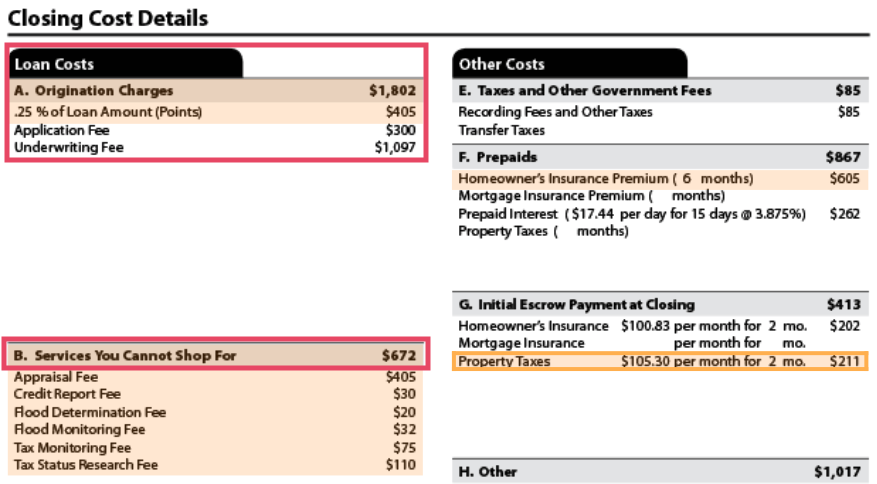

However you must understand that its the discretion of the collection agency whether or not they would negotiate further. Regardless of which path you choose you can still attempt to negotiate a lower rate whether its no cost or no fee like you would any other mortgage. Refinance closing costs typically run between 2 and 5.

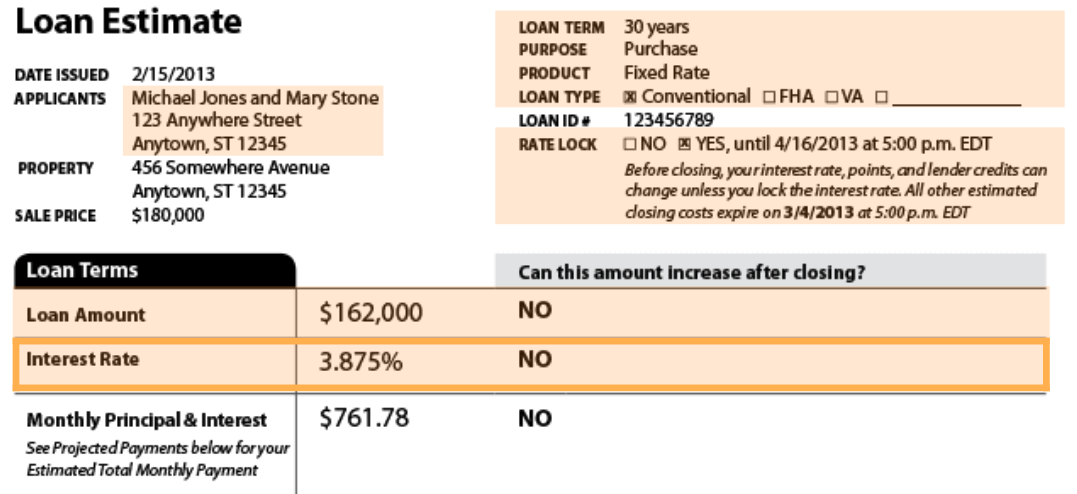

When you refinance your new home loan replaces. Tell this lender that you have another offer that is slightly better but that you would love to work with them. 6 mortgage rate 7500 in fees.

A title policy for a refinance should cost about 700. Once a deal is in place however you are bound by its terms. Nor do you need a special relationship with your banker.

Contact your local housing authority for details and the steps. 65 mortgage rate NO fees. This brings us to the next step.

Lenders share your interest in negotiating a repayment plan. Ask if they can lower their rate slightly below their competitors. If you wish you can negotiate further with them.

Brokers can compare all the loan terms from each lender and find the best rate saving you from all the legwork. If the lender offers a slightly lowered rate then you should return to the other lender and ask if they can lower their rate slightly. When negotiating a sales price the buyer and seller can discuss these contributions and their presence will likely lead to a higher contract price.

The total number of payments for the life of the loan which for monthly payments is the number of years times twelve for example 20. You can shop around for lower costs and you can negotiate this fee. When it comes to negotiating you should always be prepared to walk away.

As a result the buyer still pays the closing costs by accepting a higher loan amount associated with a higher purchase price. If your lender is refusing to buckle and offer you a competitive rate dont be put off by the process of refinancing. Mortgage rates and conditions vary from week to week.

Keep Room for Negotiations. Deciding whether to refinance your mortgage means considering your personal situation the prevailing interest rate environment and something that really hits close to home. Your lender may be unwilling to budge and you may decide to refinance with someone else.

How to Lower Your Closing Costs Lets look at an example of a no cost refinance. As you negotiate terms extra scrutiny must be given to collections agencies well removed from the original loan or line of credit in question. If you want to negotiate a lower mortgage Mortgage House and our team of brokers can help you find the best rate.

The lender company is willing to help but only if they are convinced that youll be able to pay off the amount via proposed alterations. If youre refinancing your conforming mortgage and dont have 20 equity in your home youll keep paying private mortgage insurance. Frank Pellegrini owner Prairie Title Services in Oak Park Illinois says that a title insurance policy -- including the search of public records that a title company performs -- should cost about 1500 on a 250000 home.

Refinancing with a new lender doesnt mean youll have to deal with two mortgage companies. You can ask your loan servicer about the relief options its offering. If you are confident that your financial crises are temporary you can negotiate a loan modification option.

One way to do that is to purchase a fixed-payment annuity from a AA-rated insurance company for a period equal to the term of the mortgage say 15 years. Simply shopping around and negotiating will get you the same mortgage discounts 99 per cent of the time. Some states are also offering mortgage relief programs including suspension of mortgage payments foreclosures and evictions.

There are also roundups of mortgage servicers options online such as these from the American Bankers Association and NerdWallet. Mortgage brokers do business with multiple lenders. Their fees are paid by the financial institution for every loan they bring in.

To do the calculations yourself you will need to divide this number by twelve 003 12 00025 because mortgage interest compounds monthly. Instead of negotiating with banks yourself you can hire a broker. The services of a mortgage broker are free.

7 Steps To Maximize Mortgage Refinance Savings Nerdwallet

7 Steps To Maximize Mortgage Refinance Savings Nerdwallet

How To Negotiate Refinancing Costs Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Negotiate Refinancing Costs Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Refinance Closing Costs How To Lower And Avoid Fees

Refinance Closing Costs How To Lower And Avoid Fees

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Negotiate A Better Mortgage Rate Fox Business

How To Negotiate A Better Mortgage Rate Fox Business

5 Ways To Negotiate Your Mortgage Rate And Save Money

5 Ways To Negotiate Your Mortgage Rate And Save Money

How Do I Negotiate A Mortgage Refinance If I Lost My Job Lovetoknow

How Do I Negotiate A Mortgage Refinance If I Lost My Job Lovetoknow

5 Ways To Negotiate Your Mortgage Rate And Save Money

5 Ways To Negotiate Your Mortgage Rate And Save Money

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can You Negotiate Refinance Closing Costs Mortgage Info

Can You Negotiate Refinance Closing Costs Mortgage Info

How To Negotiate Your Mortgage Closing Costs Bankrate

How To Negotiate Your Mortgage Closing Costs Bankrate

Are Mortgage Rates Negotiable The Truth About Mortgage

Are Mortgage Rates Negotiable The Truth About Mortgage

Comments

Post a Comment