Does Allstate Cover Mold Damage

Coverage is mainly dependent on the source of the moisture and the cause of the growth. Strategies for a mold insurance claim.

Allstate Homeowners Insurance Review Valuepenguin

Is mold damage covered by homeowners insurance.

Does allstate cover mold damage. A standard policy includes four key types of coverage. Register your Allstate Insurance Case If you feel you qualify for damages or remedies that might be awarded in a possible class action or lawsuit please fill in our form on the right to submit your complaint. Its a good question to ask particularly if youre.

So if its age or an unresolved maintenance issue are to blame for your leaking roof homeowners insurance likely wont pay to repair the leak or the resulting damage. However homeowners insurance generally does not cover damage resulting from lack of maintenance or wear and tear. Heres another important thing to keep in mind.

State Farm specifies that a standard policy includes a minimum of 10000 to identify and repair damage from mold and fungus. When the Allstate mold endorsement talks about the 5000 sub-limit for mold it does so in terms of remediation which the endorsement defines as covering repairs investigation and ALE. It can also cover a structure thats attached to your home like an attached garage.

Not only will you obtain some coverage for mold you could potentially lower your home insurance rates by switching insurers. They are one of the only insurance companies that offer mold coverage. However they do help cover a wide variety of other losses.

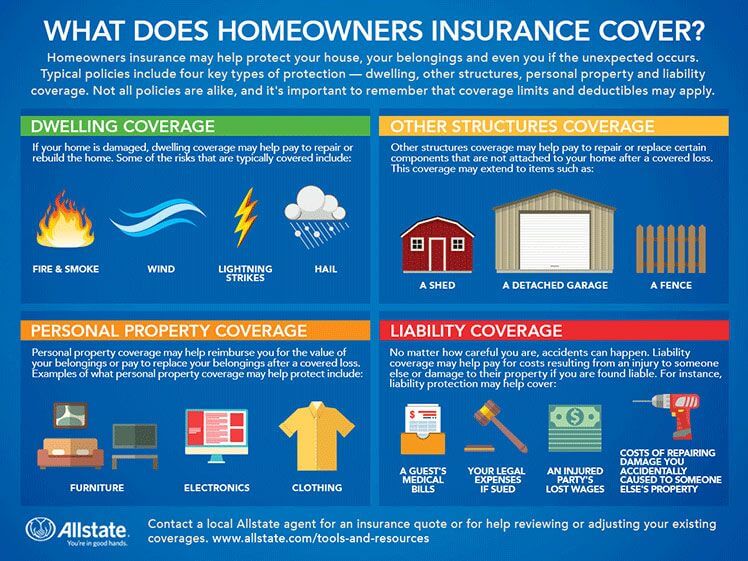

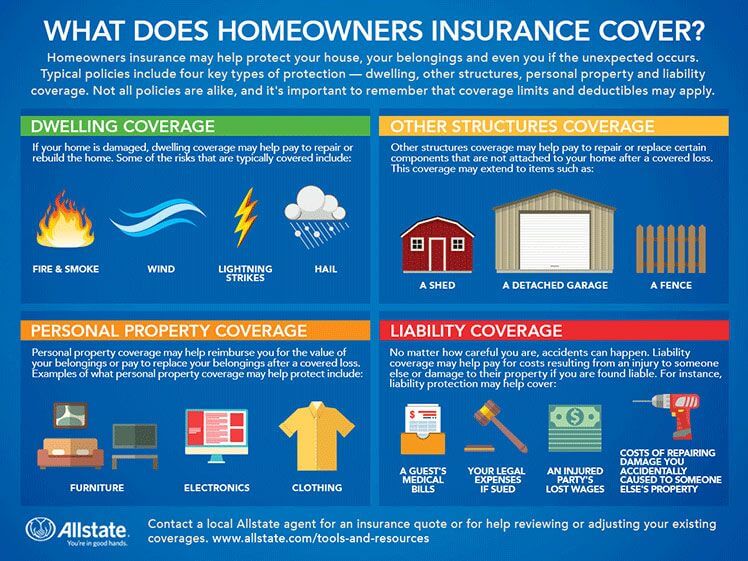

Dwelling other structures personal property and liability. Allstate Home Insurance Cover Mold. Otherwise an insurance company will likely not cover mold damage.

Luckily mold coverage is covered in standard Allstate home insurance policies. What does homeowners insurance cover allstate what does homeowners insurance cover allstate does homeowners insurance cover water damage allstate when your insurance will and won t cover mold damage valuepenguin. There are only select instances in which your insurance company will pay for mold remediation and these include covered peril situations which see mold as a result of a covered event.

But even with covered events policies could contain mold exclusions. Allstate for example provides coverage up to 5000. Homeowners insurance is designed to cover you against various types of damage but you may be wondering whether that includes mold.

The class is asking for compensatory damages of the mold coverage limit of 10000 and attorney and court costs. Remember typically your insurance will pay for covered damages if. Flood damage is not covered by a standard homeowners policy.

However you may be able to purchase flood insurance 3 through the National Flood Insurance Program. Some policies will cover damages if it can be associated to an actual loss that was covered and the mold is a result of that loss for example big water damage causing mold. Generally policies offer no coverage for mold due to maintenance issues.

Allstate Mold Damage Coverage. Lets say a detached structure on your property like a shed is damaged by a fire. If your home is damaged by a covered event like strong winds dwelling coverage can help pay to repair it.

The only downside is that Allstate imposes a 5000 coverage limit on mold damage. Like many other national insurance companies Allstate has partnered with SERVPRO making us a preferred vendor. For instance Allstate provides mold coverage but it imposes a 5000 coverage limit on claims.

Call us today for a free consultation 1-888-551-0514 Mold and Insurance Claims. Typically they will only cover such damage up to a certain limit. Typical homeowners insurance policies dont cover damage to your structure from things like flooding or earthquakes.

Mold damage from negligence or lack of maintenance is not covered. Homeowners insurance will cover mold but only if its the result of a covered event such as a burst pipe. Even if mold damage is covered in this way however it may not be covered entirely.

Allstate may cover mold if its the result of a burst pipe or other. Home insurance covers mold damage if it was caused by a covered peril. Your home insurance wont cover you for mold damage if mold forms in your shower or a burst pipe in your basement goes unnoticed and.

When Mold Is And Isnt Covered Mold is covered by your homeowners insurance if it is the result of water damage related to what the insurance industry terms. Instead it typically helps pay to repair sudden accidental damage. Whats people lookup in this blog.

Mold damage is generally not covered as a stand-alone situation. Mold damage remediation costs an average of 15000 to 30000 and insurance companies have taken numerous steps to reduce their exposure to having to pay for these damages. Watch more videos for more knowledge Does the Average Homeowners Insurance Cover.

Allstate Homeowners Insurance Cover Mold. If mold is a big concern for you consider switching insurance providers to one that offers coverage. For example dont expect insurance to help if you had a pipe that leaked for a while and caused mold or you have mold due to a humid climate.

Does Homeowners Insurance Cover Water Damage Allstate

Does Homeowners Insurance Cover Water Damage Allstate

Does My Homeowner S Insurance Cover Mold From Water Damage

Does My Homeowner S Insurance Cover Mold From Water Damage

Does Homeowners Insurance Cover Storm Damage Allstate

Does Homeowners Insurance Cover Storm Damage Allstate

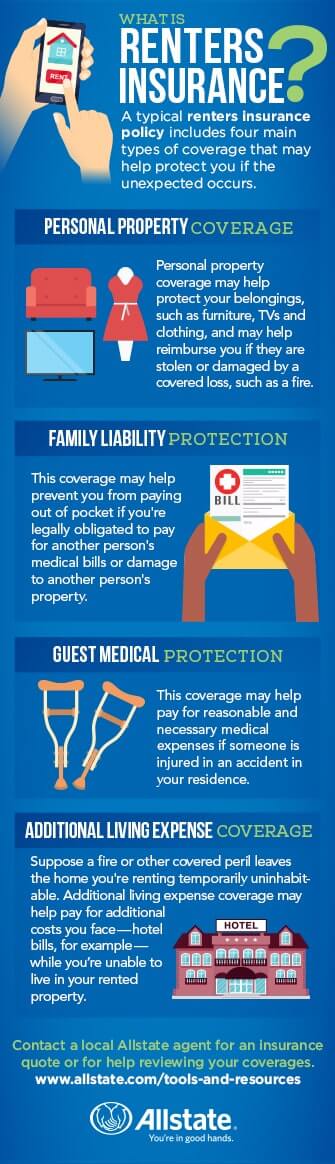

What Is Renters Insurance And What Does It Cover Allstate

What Is Renters Insurance And What Does It Cover Allstate

How To Clean Up Mold In Your Home After A Flood Allstate

How To Clean Up Mold In Your Home After A Flood Allstate

When Does Home Insurance Cover Mold Valuepenguin

Allstate Homeowners Insurance Ogletree Financial

Allstate Homeowners Insurance Ogletree Financial

Allstate Home Insurance Apr 2021 Review Finder Com

Allstate Home Insurance Apr 2021 Review Finder Com

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

Does Homeowners Insurance Cover Roof Damage Allstate

Does Homeowners Insurance Cover Roof Damage Allstate

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

Does Homeowners Insurance Cover Mold Forbes Advisor

Does Homeowners Insurance Cover Mold Forbes Advisor

Allstate Homeowners Insurance Ogletree Financial

Allstate Homeowners Insurance Ogletree Financial

Comments

Post a Comment