University Of Washington Address For Taxes

The UW Foundations federal tax id is 94-3079432. Schmitz Hall 1410 NE Campus Parkway Box 355852 Seattle WA 98195-5852 206-543-9686 Map.

Williams And Pfaff Warn Of Impact Of Tax Bill On Graduate Students Seattle Times The Henry M Jackson School Of International Studies

Williams And Pfaff Warn Of Impact Of Tax Bill On Graduate Students Seattle Times The Henry M Jackson School Of International Studies

If your Primary Home Address is an out-of-state address you may be assessed state withholding tax.

University of washington address for taxes. Washington state university address for taxes In addition to title and escrow fees and real estate commissions a home seller in Washington pays real estate excise tax. Sumers Welcome Center 1 Wrighton Way St. PO Box 64XXXX.

Leadership Admissions Officers Admissions Services Coordinators Visitor. Tax Department Campus Box 1034 700 Rosedale Avenue St. Louis One Brookings Drive St.

What are the tax benefits of a gift to the UW. Find us on campus at. Tax forms commonly called tax returns are usually due April 15th based on earnings or presence in the US.

Please see Other Tax-Related Contacts below for questions regarding Forms 1098-T 1098-E 1095-C W-2 and stipend tax letters. The Glacier Tax Prep software can help international students prepare their personal annual report for the US. If you are expecting to receive a check directly in your department you should use your departments address on the W-9 form.

You can mail your check to the following address. Find a provider. MondayFriday 9 am5 pm.

During the previous calendar year though there may be exceptions to the April 15th deadline. Even if you used Glacier Compliance when you began working you will also need to use Glacier Tax. Name Title or student Department or Hall University of Washington Building Room Number Box 35XXXX Street Address if there is one available.

Additional tools and resources. Sign up for free. Were here to help.

The amount owed is a percentage of the final sales price. Alumni have translated their. The homeowner pays the tax when the sale closes.

Governments tax agency IRS. Proceeds from the excise tax are deposited into public works and city-county assistance. The University of Washington will require students on all three campuses to be vaccinated against COVID-19 before the start of the autumn quarter.

Up to three years of Forms 990. For all all other federal tax forms the official address is 4333 Brooklyn Ave NE Seattle WA 98195-9555. Why this is important.

Purple downward facing arrow. University of Washington Foundation Box 359505 Seattle WA 98195. Its the employees responsibility to either retrieve their tax form online through Workday or contact the ISC to request a replacement tax form.

Contact Student Financial Services. Washington state residents do not pay state withholding tax. Returned tax forms are not re-mailed.

MSC 1089-105-05 Washington University in St. Vaccinations are provided free of charge to individuals at UW Medicine hospitals as well as at mass vaccination sites in Seattle and in Pierce and Snohomish counties. CEO Board Chair and Board of Directors information.

Your gift may be tax deductible as charitable contributions for federal tax purposes as allowed by IRS regulations. The Glacier Tax Prep GTP system available in March is different. The University Tax Office does not provide individual income tax advice.

University Tax Department Contacts. Our programs and research engage with literature rhetoric culture theory criticism history pedagogy and creative writing. Tax forms sent by USPS mail with undeliverable addresses are returned to the ISC.

Zip code list. However not all tax forms are issued through the Tax Department. Except for UW closures.

For use tax reversal questions please contact the Tax office at 206-685-0271 or usetaxuwedu Questions not addressed by this website and questions regarding unrelated business income tax tax policy and foreigninternational taxes may be directed to the Tax Office at 206-685-0271. Be sure to use the units individual 4-digit extension in the PO Box and zip code. This report has information on your immigration situation tax status and if applicable -- taxable income.

Do you have a question and cant find the answer. Revenue and expense data for the current fiscal year. Thank you for your interest in the University of Washington.

As an international scholar at the University of Washington you must file certain tax forms each year with the IRS even if you earned no income. I need help completing my tax return. Returning to campus Autumn quarter 2021.

Check the online departments website or ask the person you are sending mail to Seattle WA 98195-XXXX.

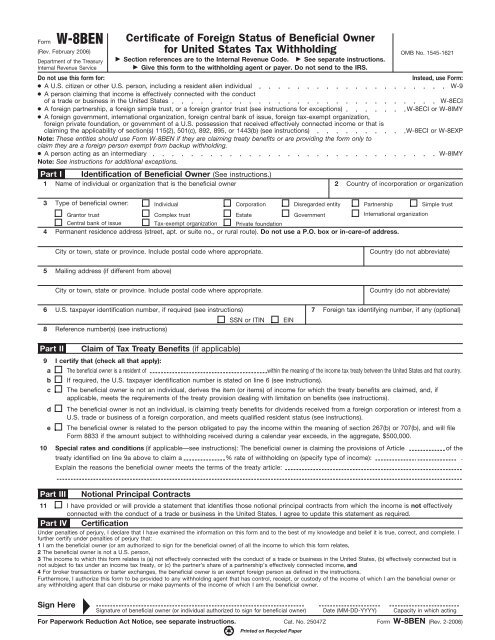

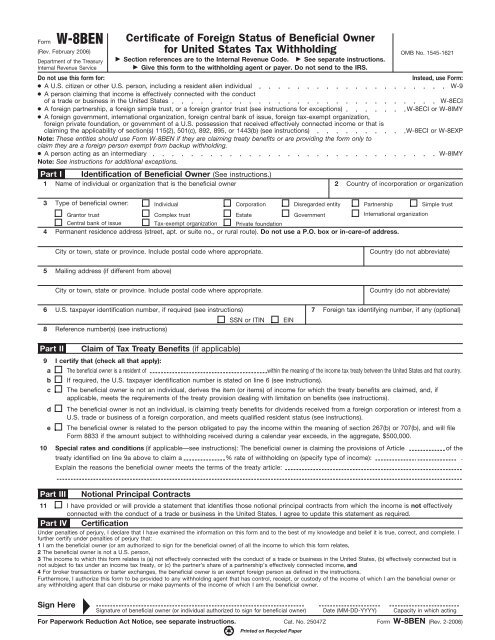

Tax Form W8ben University Of Washington

Tax Form W8ben University Of Washington

Kuow Tax Hike On Amazon And Microsoft Will Help Pay College Tuition

Kuow Tax Hike On Amazon And Microsoft Will Help Pay College Tuition

1 Non U S Resident Taxes Nra University Of Washington Student Fiscal Services Ppt Download

1 Non U S Resident Taxes Nra University Of Washington Student Fiscal Services Ppt Download

Uw Prof Cliff Mass Called Racist For Opposing Carbon Tax Initiative

Uw Prof Cliff Mass Called Racist For Opposing Carbon Tax Initiative

University Of Washington The Princeton Review College Rankings Reviews

University Of Washington The Princeton Review College Rankings Reviews

Tax Hike On Employers Will Help Make College Free For Many Students In Washington State

Tax Hike On Employers Will Help Make College Free For Many Students In Washington State

Student Fiscal Services Student Fiscal Services

Student Fiscal Services Student Fiscal Services

Gop Tax Bill Could Turn 7 000 Uw Grad Students Worlds Upside Down Crosscut

Gop Tax Bill Could Turn 7 000 Uw Grad Students Worlds Upside Down Crosscut

University Of Washington The Princeton Review College Rankings Reviews

University Of Washington The Princeton Review College Rankings Reviews

University Of Washington The Princeton Review College Rankings Reviews

University Of Washington The Princeton Review College Rankings Reviews

Non U S Resident Taxes Nra University Of

Non U S Resident Taxes Nra University Of

Uw Wsu Protest Plan To Tax Tuition Waivers For Grad Students The Seattle Times

Uw Wsu Protest Plan To Tax Tuition Waivers For Grad Students The Seattle Times

Comments

Post a Comment