Maryland Tax Brackets

The values of these deductions for tax year 2001 are as follows. 2 cents if the taxable price is at least 21 cents but less than 34 cents.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Additionally there is a statewide income tax in Maryland with a top rate of 575.

Maryland tax brackets. Although the state does not have personal property tax rates there are some counties that do. While those combined state and local taxes place Maryland in the top half of US. Nonresidents are subject to a special tax rate of 225 in addition to the state income tax rate.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Maryland state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with MD tax rates of 2 3 4 475 5 525 55 and 575 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Each of these marginal rates is only applicable to earnings within the corresponding tax bracket.

For tax year 2020 Marylands personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 575 on incomes exceeding 250000 or 300000 for taxpayers filing jointly heads of household or qualifying widowers. 1 cent on each sale where the taxable price is 20 cents. Maryland Income Tax Rates and Brackets.

For most employees who are not residents of Maryland the Nonresident rate 70 is used which includes no local tax. In Maryland different tax brackets are applicable to different filing types. Here is a list of our partners and heres how we make money.

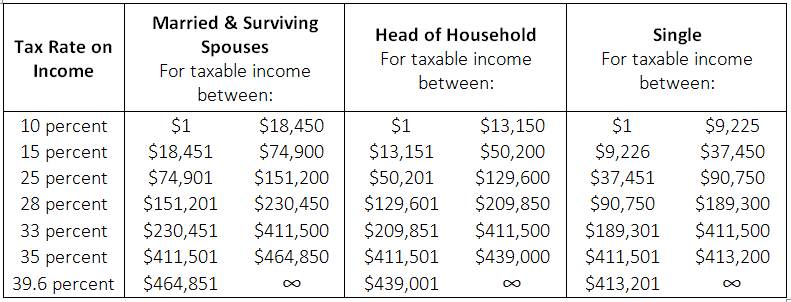

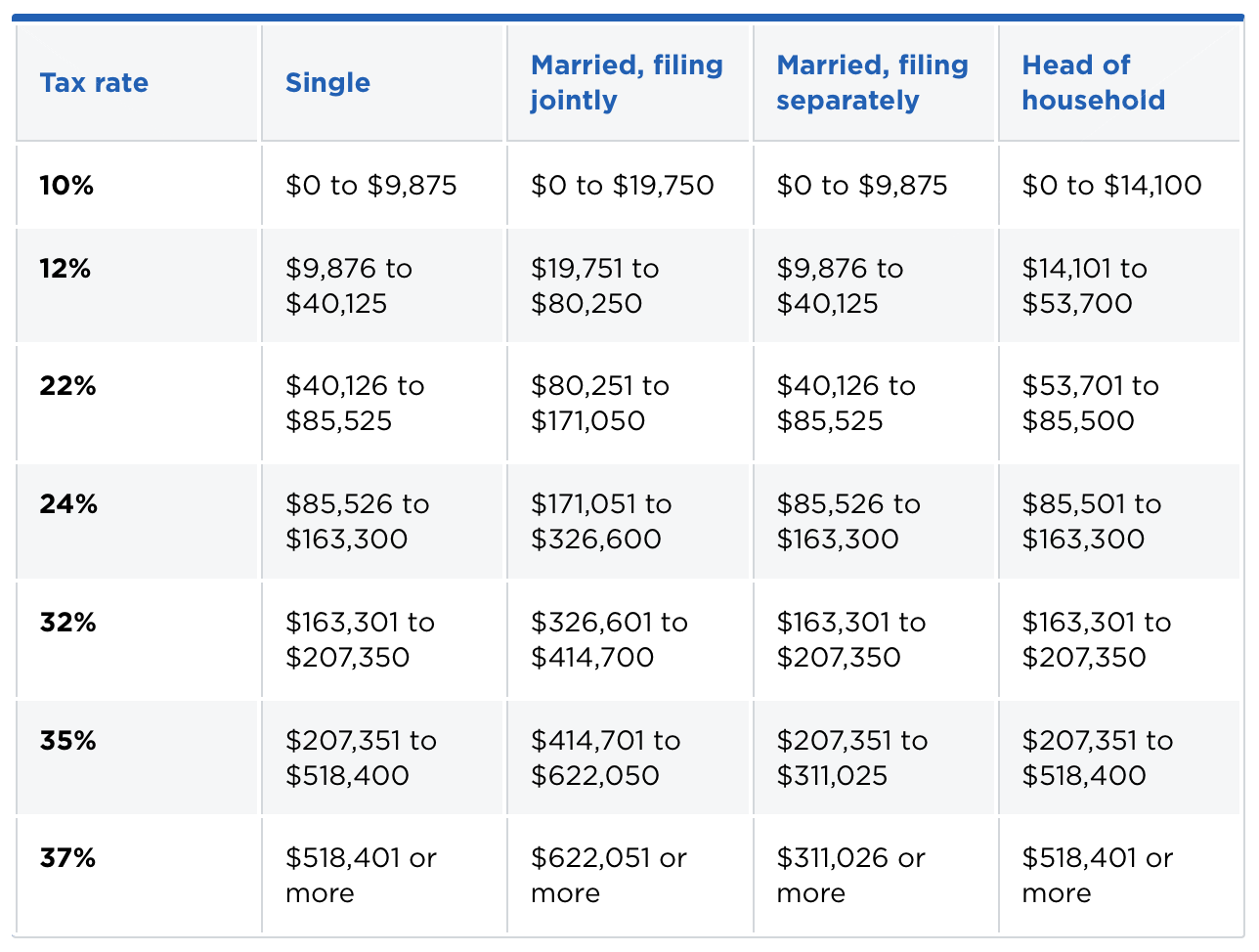

For example a single filer who made 10000 would pay 10 income tax on their first 9950 and. 10 12 22 24 32 35. If your income is under 100000 use the tax tables in the Maryland income tax booklet to figure your tax.

Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. Of local tax which for the year 2021 will be 320. 3 cents if the taxable price is at least 34 cents but less than 51 cents.

Every August new tax rates are posted on this website. The bill also raises the minimum for local income taxes to 225 up from 1 to match the current rate in Worcester County which has the lowest rate in the state. Employees may be eligible to claim an EITC on their 2020 federal and Maryland income tax.

Each tax rate is reported to the Department by local governments each year. States for income taxes its state sales tax of 6 is relatively quite low. Understanding Maryland Tax Bracket In Maryland taxation is governed by eight marginal tax brackets for which the marginal rates include 2 3 4 475 5 525 550 and 575.

This means that different portions of your taxable income may be taxed at different rates. Maryland has eight marginal tax brackets ranging from 2 the lowest Maryland tax bracket to 575 the highest Maryland tax bracket. View Current-Year Maryland Income Tax Brackets View Past Years Brackets.

Deduction numbers arent available for Maryland for this tax year. Do not use this overview to figure your tax. View Current-Year Maryland Income Tax Brackets View Past Years Brackets.

There are seven federal tax brackets for the 2020 tax year. The states property taxes at an average effective rate of. The values of these deductions for tax year 2012 are as follows.

Counties are responsible for the county tax rates local towns and cities are responsible for their tax rates and the state is responsible for the states tax rates. The values of these deductions for tax year 2018 are as follows. As amended the bill limits the highest local income tax rates to 32 which 11 counties and the city of Baltimore already impose.

Local Tax Rate Chart. 2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate Carroll County 1018 2515. The chart shown below outlining the 2020 Maryland income tax rates and brackets is for illustrative purposes only.

Specifically counties in Maryland collect income taxes with rates ranging from 225 to 320. Counties can still set different brackets for different income levels. Businesses in Maryland are required to collect Marylands 6 percent sales tax and or 9 percent alcoholic beverage tax from you whenever you make a taxable purchase.

But does include the Special 225 Nonresident rate.

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates Around The World Tax Foundation

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

Need To Know Changes For Small Business Owners 2015 Edition

Need To Know Changes For Small Business Owners 2015 Edition

Who Determines What Is Fair Or Whatever Happened To Critical Thinking Raised On Hoecakes

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

State Income Tax Rates And Brackets 2021 Tax Foundation

State Income Tax Rates And Brackets 2021 Tax Foundation

Gop Tax Bills Discriminate Against Maryland Seventh State

Historical Maryland Tax Policy Information Ballotpedia

Historical Maryland Tax Policy Information Ballotpedia

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Com

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Com

Tax Brackets 2020 Passive Income M D

Tax Brackets 2020 Passive Income M D

Building Our Future Maryland Center On Economic Policy

Maryland S Tax Code Penalizes Marriage Samuel Tax Consulting

Maryland S Tax Code Penalizes Marriage Samuel Tax Consulting

Comments

Post a Comment