California Prepaid Tuition Plan

Below are the private colleges and universities that offer a prepaid tuition plan or tuition guarantee. Get the truth behind these prepaid.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2020 My Money Blog

When your beneficiary is ready to enroll in college the plan will pay the school directly for the prevailing rate of tuition.

California prepaid tuition plan. Private Colleges that Offer Prepaid Tuition Plans. If your child decides to go to a private or out-of-state institution you might receive only a small return on your original investment. Prepaid tuition plans allow parents and grandparents to do exactly that.

Prepaid tuition plans are a type of 529 plan. Participation in the Plan does not guarantee admission to any college or university. You take on more investment risk while giving your child the.

The College Illinois Prepaid Tuition Plan the Bright Start College Savings Plan and the Bright Directions College Savings Program and allows a deduction of up to 20000 per year for joint filers per beneficiary for contributions to these programs. Has three qualified tuition programs. If youre considering paying for college in installments make sure to sign up for payment deferment well before classes start.

A multitude of pricing schedules exists. Some schools offer both and therefore appear twice in these lists. Harding University AR Ouachita Baptist University AR Philander Smith College AR Chapman University CA Occidental.

The alternative is to choose a state prepaid plan where parents buy tuition credits that are generally redeemed at a future years public in-state tuition rate. Pay for future college tuition at current rates. This prepaid tuition plan has three basic plans.

College payment plans can be a flexible way to pay for your education. Intuition College Savings Solutions LLC Intuition is the Plan Administrator. The average published price of tuition and fees at a public university is 9410 according to the College Board.

You contribute regularly and rely on the accounts earnings to grow. A prepaid tuition plan is a college savings plan that allows you to pay for future college tuition at todays rate. Discover more tips for college payment options.

University Plan covering UIUC. Community College Plan covering Illinois community colleges. A prepaid tuition plan is a type of 529 plan that allows an account holder known as a saver to buy units credits or numbers of years of tuition at participating schools for the future education expenses of a student beneficiary.

Performance is the funds. There are currently 18 state-sponsored and one institution-sponsored prepaid plan Private College 529 Plan but only 10 are currently accepting new applicants and eight of these have residency requirements. You lock in current tuition rates at in-state public institutions.

Earnings if any are tax-deferred and disbursements when used for tuition and other qualified higher education expenses are federal and state tax-free. University Plan covering Illinois public universities except for University of Illinois at Urbana-Champaign UIUC. Applicable expenses include tuition and mandatory fees but not room and board or tuition for elementary or secondary schools.

Private College 529 Plan the Plan is established and maintained by Tuition Plan Consortium LLC TPC. A bill to reduce parents fears about skyrocketing college tuition costs by allowing them to pre-purchase a college education for their child at a California public university at todays prices. It can be challenging to pay for a college term in one lump sum.

Prepaid tuition plans With this type of 529 plan if your contract is for four years of tuition tuition is guaranteed regardless of its cost at the time the beneficiary actually attends the school. They allow family membersparents grandparents and other relativesto pay for a students college. As the name implies prepaid tuition plans prepaid 529 plans allow you to pre-pay future college costs today.

This can provide substantial savings if you invest when the child is still very young. Illinois requires an add-back to income for non-. Fee is the percent of the fund deducted annually for fees based on a moderate risk age-based portfolio for a child ages 0-6.

You can purchase units or credits either in a lump-sum payment or in regular. There are two basic types of 529 plans. ScholarShare the state-administered 529 college savings plan provides families with a tax-advantaged way to deposit after-tax contributions to save for future college expenses.

Prepaid plans allow you to purchase tuition credits units or years either with one lump-sum payment or through monthly installments. Thats where installment plans come in. Room and board adds another 10140.

Colleges Accepting Prepaid Tuition Plan In California Univstats

Colleges Accepting Prepaid Tuition Plan In California Univstats

Top 6 Myths About Prepaid Tuition Plans

Top 6 Myths About Prepaid Tuition Plans

529 Plans 529 College Savings Plans What Is A 529 Plan

529 Plans 529 College Savings Plans What Is A 529 Plan

Pros And Cons Of Prepaid College Tuition Plans

Pros And Cons Of Prepaid College Tuition Plans

Prepaid Tuition Plans What To Know And How They Compare

Prepaid Tuition Plans What To Know And How They Compare

Prepaid Tuition Plans Pros Cons How They Work More

Prepaid Tuition Plans Pros Cons How They Work More

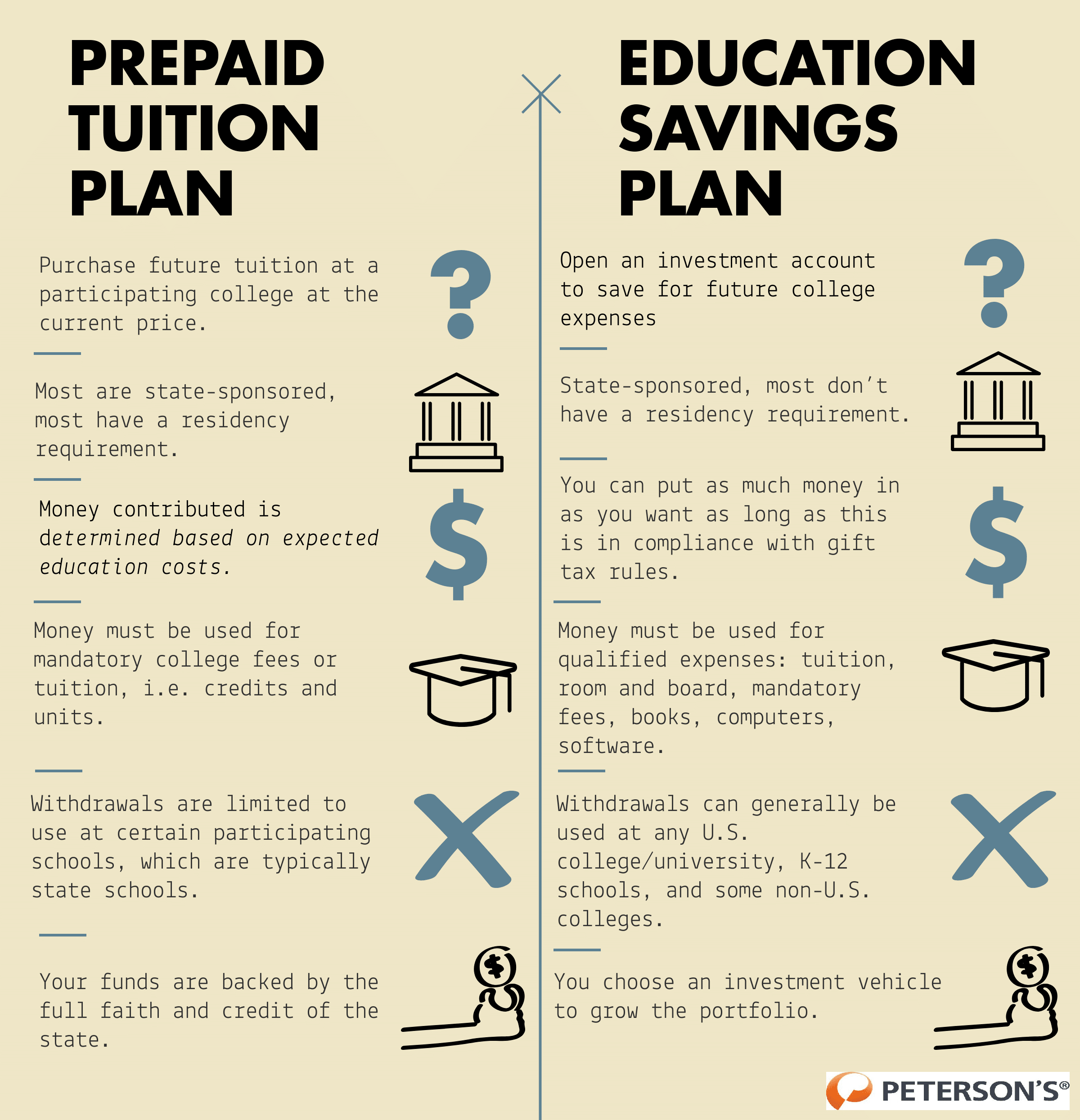

Prepaid Tuition Vs College Savings Plans Allstate

Prepaid Tuition Vs College Savings Plans Allstate

Prepaid Tuition Plans The College Funding Coach

Prepaid Tuition Plans The College Funding Coach

California 529 Plan And College Savings Options Scholarshare

California 529 Plan And College Savings Options Scholarshare

What Is The Best 529 Plan In California Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

529 Prepaid Tuition Plan California

529 Prepaid Tuition Plan California

Save And Pay For College With 529 Plans

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/college-graduate-taking-selfie-with-parents-1023227208-b69869c2ce78461bbe7dd6c8fc134962.jpg) Prepaid Tuition Plan What Is It

Prepaid Tuition Plan What Is It

Comments

Post a Comment