Tax Percentage In Md

No changes Has been made in Maryland. The Maryland bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Https Www Marylandtaxes Gov Statepayroll Static Files 2021 Memos 2021 Maryland State And Local Income Tax Withholding Information Pdf

For 2020 the rate of withholding for Maryland residents is 575 plus the local tax rate.

Tax percentage in md. Tax rate of 3 on taxable income between 1001 and 2000. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax. Counties in Maryland collect an average of 087 of a propertys assesed fair.

For Maryland nonresidents the rate is increased to 80 the resident rate of 575 plus the nonresident rate of 225. However because property values in Maryland are also high homeowners here pay more in annual property taxes than in most other states. 6 is the smallest possible tax rate Waldorf Maryland The average combined rate of every zip code in Maryland is 6.

The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000. For Maryland residents employed in Delaware the rate is 32. Our Maryland State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 10000000 and go towards tax.

Local rates range from 225 to 320. For single taxpayers living and working in the state of Maryland. Nonresidents are subject to a special tax rate of 225 in addition to the state income tax rate.

Using our Maryland Salary Tax Calculator. 2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate Carroll County 1018 2515. For tax year 2020 Marylands personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 575 on incomes exceeding 250000 or 300000 for taxpayers filing jointly heads of household or qualifying widowers.

Maryland state rates for 2021. Once you have submitted the information this system will generate a PVW Worksheet. Maryland Income Taxes The state income tax in Maryland has a top rate of 575 percent but any income earned is taxed at a rate of at least 2 percent at the state level.

Consumers use rental tax sales tax sellers use lodgings tax and more. Tax amount varies by county. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Tax rates range from 2 to 575. The list focuses on the main indicative types of taxes. Designated Distributions are only subject to Maryland.

Please refer to the Maryland website for more sales taxes information. Revised 72320 Page 2 of 7 County and. This Maryland bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

The bonus tax calculator is state-by-state compliant for those states that allow the percent. Estimated Maryland and Local Tax Calculator - Tax Year 2019. Depending on where you live in Maryland however that rate will be higher by between 175 percent and 32 percent due to county income taxes.

Use this information on the PVW to. In order to determine an accurate amount on how much tax. After a few seconds you will be provided with a full breakdown of the tax you are paying.

You can use this calculator to compute the amount of tax due but this system does not allow you to file or pay the amount online. 087 of home value. 2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate.

This is an online version of the PVW worksheet. Maryland State Unemployment Tax. Tax rate of 4 on taxable income between 2001 and 3000.

Each county in Maryland charges a different rate and they range from 25 to 32. Marylands average effective tax rate of 106 is about equal to the national average. To withhold Maryland income tax from these distributions paid to Maryland residents at the rate of 775.

You can pay the relevant taxes on your Maryland state income tax return as there is no separate tax form for county or city income taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Plus employees also have to take local income taxes into consideration.

Tax rate of 2 on the first 1000 of taxable income. To use our Maryland Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The local tax rate youll pay in Maryland is based on where you live not where you work.

Some of the Maryland tax type are. While this calculator can be used for Maryland tax calculations by using the drop down menu provided you are able to change it to a different State.

Maryland Income Tax Calculator Smartasset

Maryland Income Tax Calculator Smartasset

Gop Tax Bills Discriminate Against Maryland Seventh State

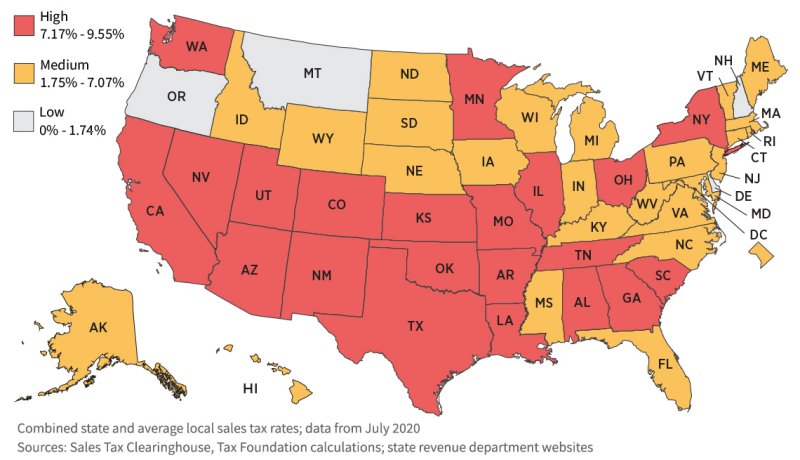

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

State And Local Sales Tax Rates 2018 Tax Foundation

State And Local Sales Tax Rates 2018 Tax Foundation

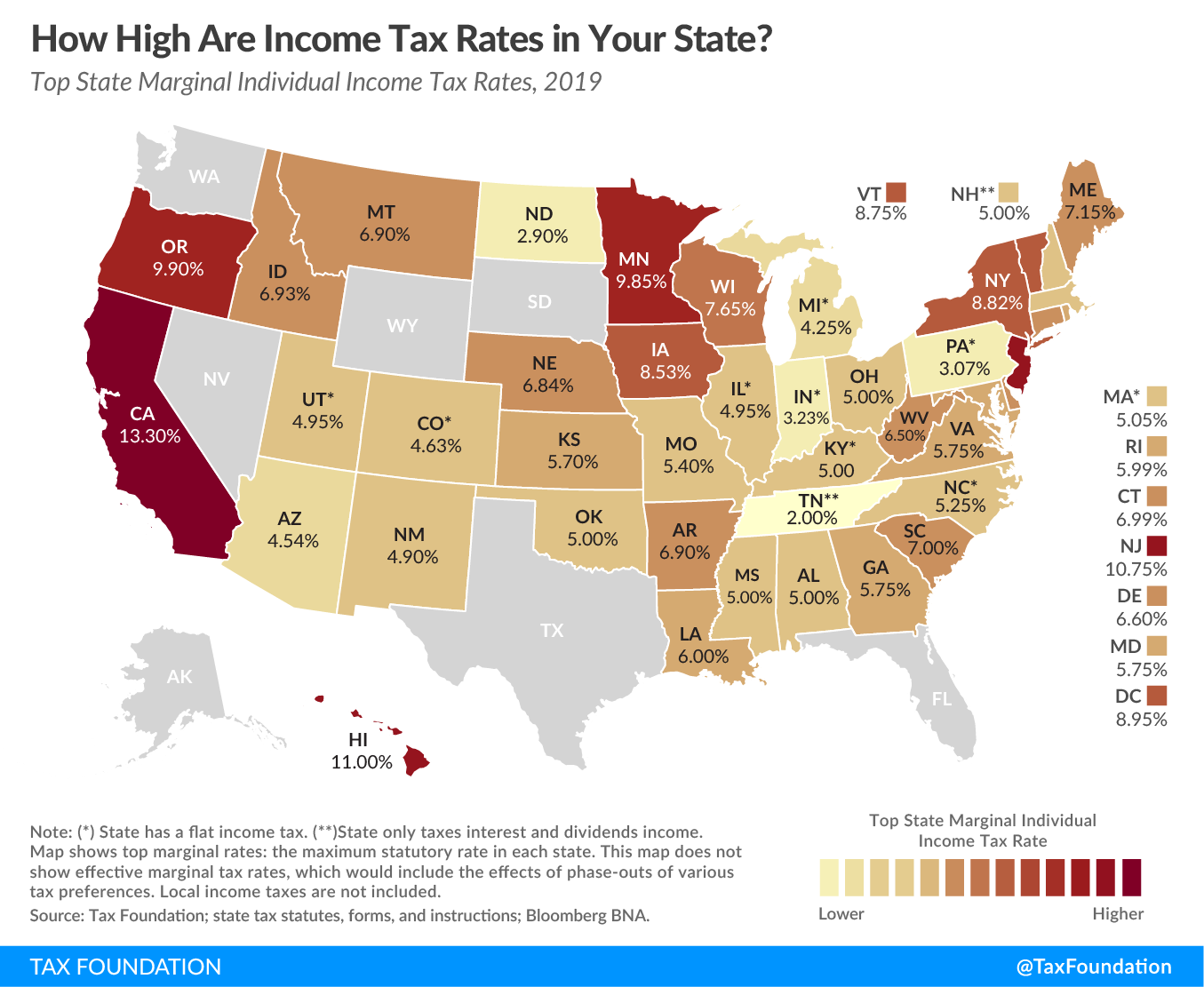

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Individual Income Taxes Urban Institute

Individual Income Taxes Urban Institute

Historical Maryland Tax Policy Information Ballotpedia

Historical Maryland Tax Policy Information Ballotpedia

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Excise Tax Rates Maryland And Neighboring States 2009 15 Download Table

Excise Tax Rates Maryland And Neighboring States 2009 15 Download Table

Tax Filing Maryland Sales Tax Filing

Maryland Income Tax Calculator Smartasset

Maryland Income Tax Calculator Smartasset

Comments

Post a Comment