What Happens To A 529 If Not Used

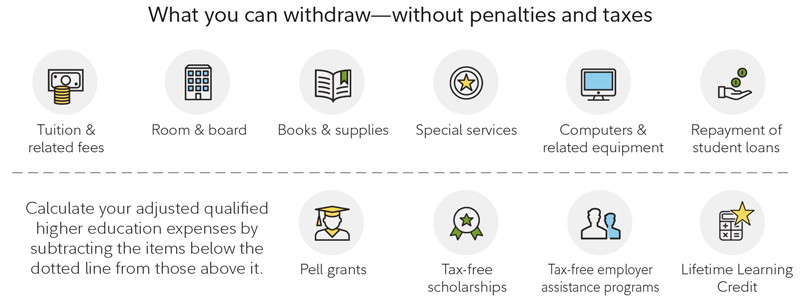

Eligible family members include the original beneficiarys siblings parents cousins nieces nephews aunts uncles grandparents spouse and children. Early or Non-Qualified 529 Withdrawals If you withdraw funds from your 529 account for non-qualified uses which might be the case if your child is drafted to the WNBA right after high school then you will be subjected to a 10 early withdrawal penalty on your investment earnings ONLY.

How To Use A 529 Plan If A Child Does Not Go To College Investing To Thrive

How To Use A 529 Plan If A Child Does Not Go To College Investing To Thrive

Only the earnings portion of a non-qualified 529 plan distribution is subject to a 10 withdrawal penalty.

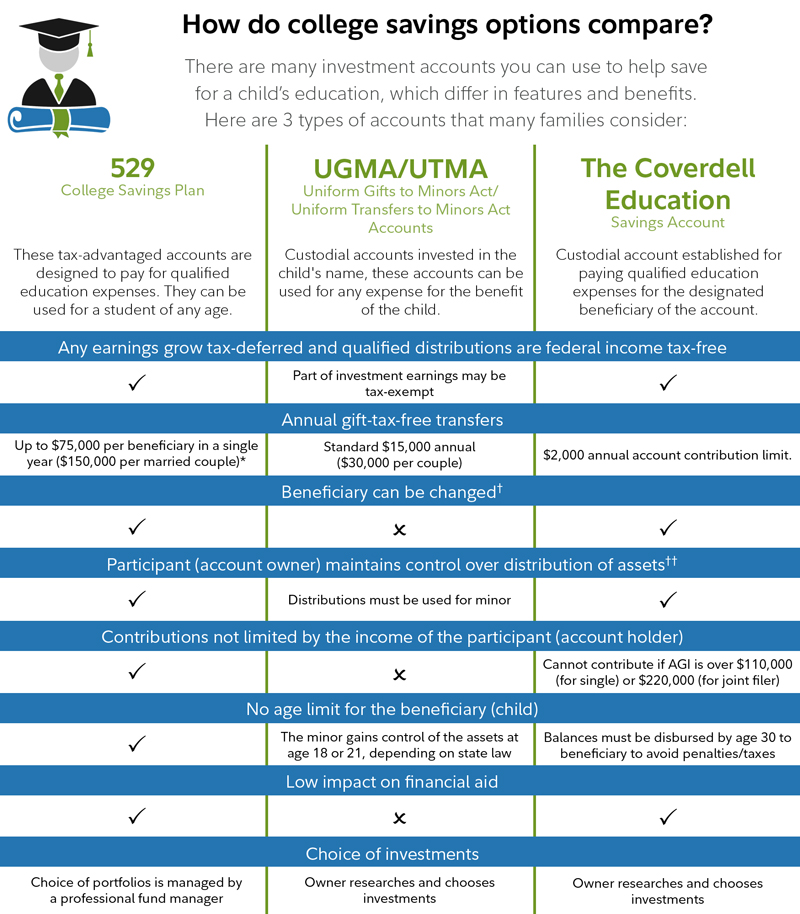

What happens to a 529 if not used. If the original beneficiary doesnt wind up going to college or not all of the money gets used you can change the beneficiary to someone else to use the rest of the money and not suffer any unexpected penalties or taxes. When you take money out of a 529 earnings and contributions are withdrawn proportionately However there are several circumstances in which you avoid the penalty. A 529 college savings plan allows families to save money for their childs college education in a tax-free investment account.

This is probably your best option. However first consider other financial solutions or whether changing your. If you opened the account for a specific child the account belongs to.

As the law legally allows the beneficiary of a 529 to be changed once a year this means unused 529 funds can be directed to anybody within your family including yourself. Because of this regulation the money you saved in a 529 plan for a spouse. Your other option is a pretty bad one.

Lets assume your child graduates from college and you have funds remaining in your 529 plan. If the money is used for anything outside of the qualified education. Heres an example of how this might play out.

If your original beneficiary isnt going to use the money in your 529 account you can choose a new beneficiary from his or her immediate family. If your child chooses not to attend post-secondary education and you have not used the funds for elementary or secondary school expenses you still have options. This means that the earnings-only portion of the withdrawal will be taxed on the federal state and local level.

You might decide to give that money to her to help in the purchase of a first home. If however you reach a point where your 529 account is simply not going to be used you can request a non-qualified withdrawal from your 529 plan. Things happen and you need to do whats right for your family.

However you will have to pay taxes and penalties on the earnings so this should be a last resort. There may be gift or generation-skipping tax consequences when you change the beneficiary so you may. One of the rules governing 529 savings plans which parents typically use to help pay for a childs college education is that when the earnings on those contributions are not used for qualified.

529 plan distributions are allocated between the earnings portion and the basis which is the contribution portion. Most 529s plans allow you to change the beneficiary once a year. The account is still your money and youre allowed to make 529 plan withdrawals that are not for educational purposes at any time.

If your child is in a. The owner of a 529 plan can change the beneficiary. What if my child opts out of post-secondary education all together.

California imposes an additional 25 state income tax penalty on the earnings portion of non-qualified 529 plan distributions. If the 529 plan you are using does not offer that option you can consider rolling over to a more accommodating 529 plan before requesting the withdrawal. Under the new tax law you can roll money over from a 529 account into a state-sponsored ABLE account the acronym stands for Achieving a Better Life.

Usually withdrawals from a 529 plan that are not used for eligible educational expenses are subject to a 10 penalty but there are some instances in which the penalty is waived. So if your child wont be using the money you can transfer the assets penalty-free to. In each of the following cases the 10 withdrawal penalty is waived but you must still.

What Happens If You Don T Use Your 529 Plan Sootchy

What Happens If You Don T Use Your 529 Plan Sootchy

How To Be Smarter With A 529 Account Wsj

How To Be Smarter With A 529 Account Wsj

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

529 Accounts What Happens When Your Child Doesn T Go To College Charles Schwab

529 Accounts What Happens When Your Child Doesn T Go To College Charles Schwab

Do Not Open A 529 Account For Your Child Until You Ve Done This Money Under 30

Do Not Open A 529 Account For Your Child Until You Ve Done This Money Under 30

What To Do With Unused 529 Plan Funds Allstate

What To Do With Unused 529 Plan Funds Allstate

What Are Qualified Expenses For A 529 Plan And What Doesn T Count

What Are Qualified Expenses For A 529 Plan And What Doesn T Count

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

How To Avoid The 529 Plan Withdrawal Penalty If Your Child Skips College

How To Avoid The 529 Plan Withdrawal Penalty If Your Child Skips College

Why A 529 College Savings Plan T Rowe Price

Why A 529 College Savings Plan T Rowe Price

:max_bytes(150000):strip_icc()/GettyImages-647056058-bba8ec5a5fc541159b733ff927048889.jpg) Why You Should Front Load Your 529 Plan

Why You Should Front Load Your 529 Plan

Look Before You Leap Into A 529 Plan Journal Of Accountancy

Look Before You Leap Into A 529 Plan Journal Of Accountancy

Comments

Post a Comment