Do You Get Money Back When You Refinance Your Mortgage

You May Get A Tax Deduction Mortgage interest is usually tax-deductible but the interest on many other types of debt is not. You can do a cash-out refinance of a home you own free and clear.

If you have a mortgage you must have had it for at least six months.

Do you get money back when you refinance your mortgage. When you are in the process of refinancing your mortgage you may come across refinance advertisements offering the chance to skip a mortgage payment for one month. If it seems too good to be true thats because it probably is. In reality while it may feel like youre keeping money in your pocket youre actually not.

A cash-out refinance is similar to a regular refinancing of your mortgage in that youre going to have to pay closing costs. Mortgage Refinance Scenario 2. If you refinanced your mortgage in 2020 there are some specific dos and donts you need to know prior to filing your income taxes as well as a few pointers that might help you lower your tax bite.

You Dont Plan on Staying in the House. Here are five times you should hold off on refinancing your mortgage. REFINANCING YOUR MORTGAGE WILL SAVE YOU THE MOST MONEY IN THESE CITIES RIGHT NOW.

If you plan on selling your home in the next five years then hold off on refinancing it. You can refinance your 100000 loan balance for 150000 and receive 50000. These can add up to hundreds or even thousands of dollars.

On the surface it. Cash-back or cash-out mortgage refinancing deals do exist and you can get money out of the loan to pay down some extra debt. When you refinance your mortgage you can borrow money at a much lower interest rate.

You initially paid 300000 for your home which appraised at 305000 for your refinance loan. You can skip a mortgage payment when refinancing and go two months without one but this can be a risky move. The move will likely only waste your time and money.

If you refinance your existing loan to get a lower interest rate or change the terms it. Youll Need An Appraisal. Refinancing isnt for everyone or every financial situation.

Youre looking to borrow 250000 or about 82 percent of your homes value to pay off your existing mortgage because you wanted better terms. In todays market thats typically around 35 45. When should you refinance your mortgage.

The following information will help to reduce your federal income taxes and get you prepared for mortgage-related tax issues in 2020 and beyond. If your home is valued at 200000 and your mortgage balance is 100000 you have 100000 of equity in your home. If you know you cannot save money unless it is due and payable on your mortgage payment each month then setting up an escrow account is the right choice for you.

Plus youre going to have to pay interest on the cash that you get out in addition of course to the mortgage amount which can add up to thousands of dollars over the life of the loan. When you refinance and set up a new escrow account it will cost you money. You still retain about 18 percent equity.

When you get a cash-out refinance you pay off your original mortgage and replace it with a new loan. If you wait until you have the loan for 12 months you would receive 58 back and if you waited until 30 months you would get 22 back. Be sure to look at the Closing Disclosure from your lender and analyze your new loan terms.

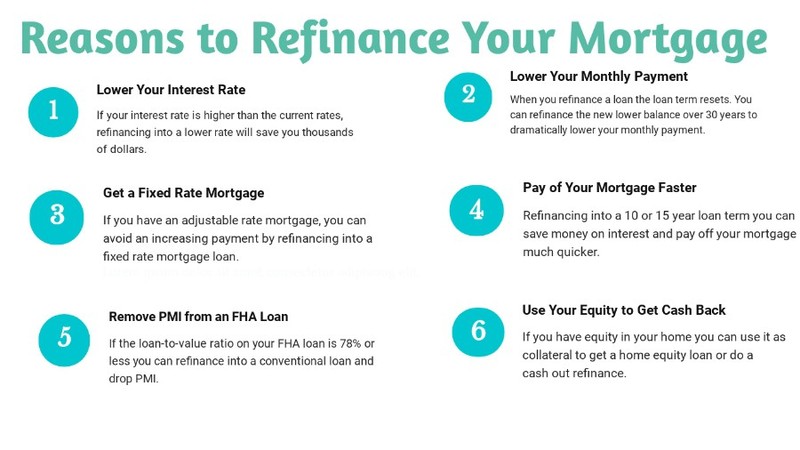

In general homeowners refinance to save on mortgage costs by. If your refinance as soon as you are eligible which is the 6 th month you have the FHA loan you would receive a 70 refund of the mortgage insurance premium. If your mortgage is due on the first of.

When refinancing a mortgage essentially you have two choices. The short answer is yes. This means your new loan may take longer to pay off your monthly payments may be different or your interest rate may change.

/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png) How To Remove A Name From A Mortgage When Allowed

How To Remove A Name From A Mortgage When Allowed

Should You Refinance Your Mortgage Peter Lazaroff

Should You Refinance Your Mortgage Peter Lazaroff

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

5 Biggest Myths About Mortgage Refinancing Bankrate Com

5 Biggest Myths About Mortgage Refinancing Bankrate Com

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

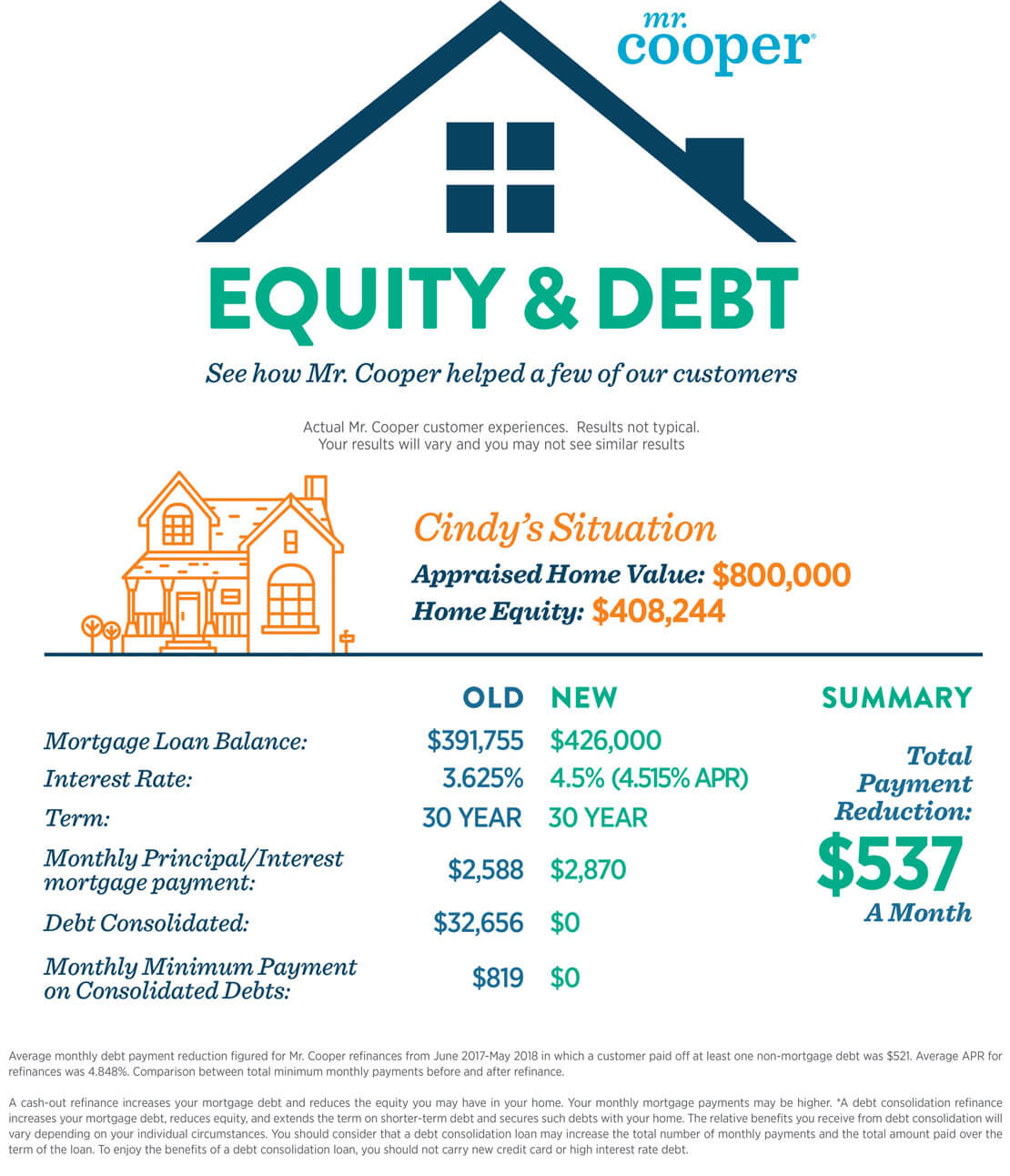

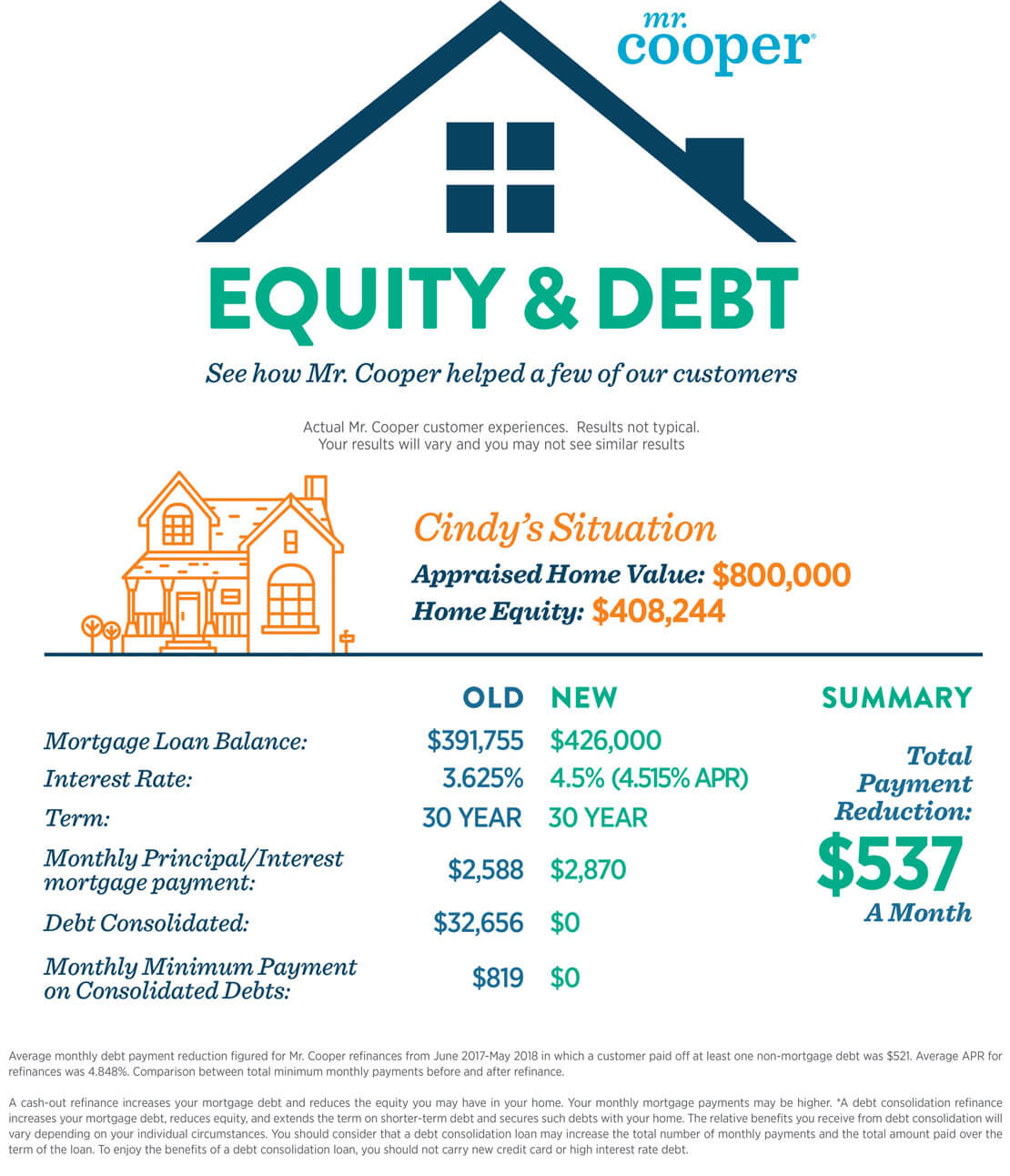

What Is A Cash Out Refinance The Mr Cooper Blog

What Is A Cash Out Refinance The Mr Cooper Blog

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance 101 What It Is And When You Should Do It Moving Com

Mortgage Refinance 101 What It Is And When You Should Do It Moving Com

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Interest Rates Are Going Up Should You Refinance Your Mortgage

Interest Rates Are Going Up Should You Refinance Your Mortgage

How Often Can I Refinance My Mortgage Ally

How Often Can I Refinance My Mortgage Ally

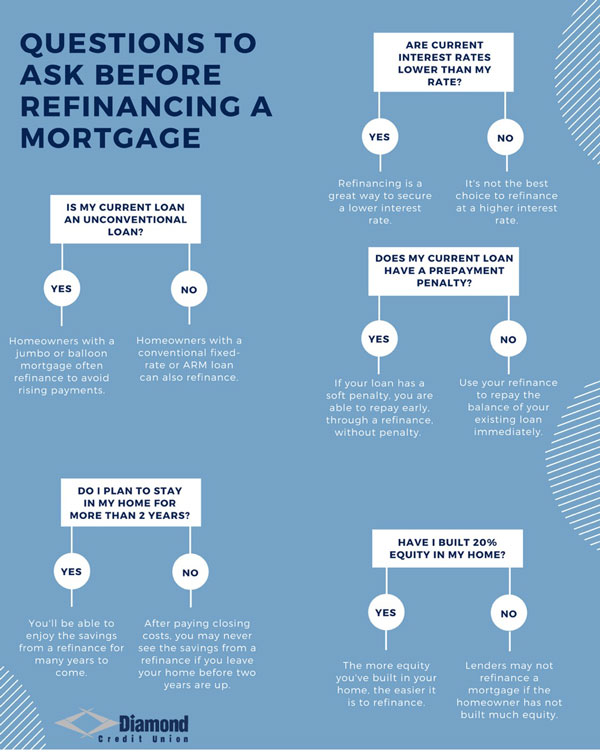

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

Comments

Post a Comment