Federal Tax Dollars By State

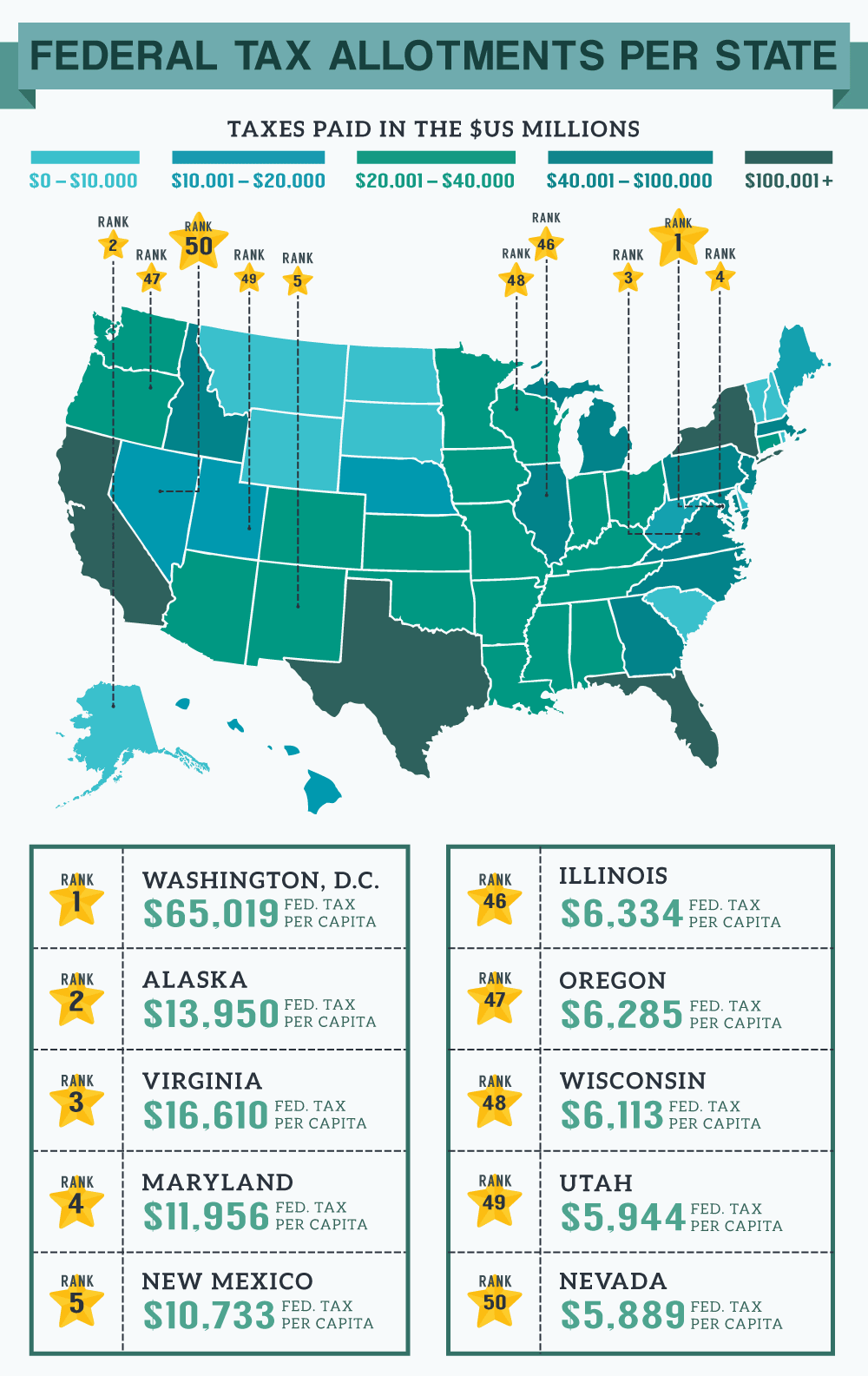

Marginal tax rates range from 10 to 37. In Virginia for instance taxpayers paid an average of 10571 in federal taxes but the federal government actually sent back a whopping 20872 per person in federal expenditures.

How Much States Receive From The Federal Government For Every Tax Dollar 600x515 Mapporn

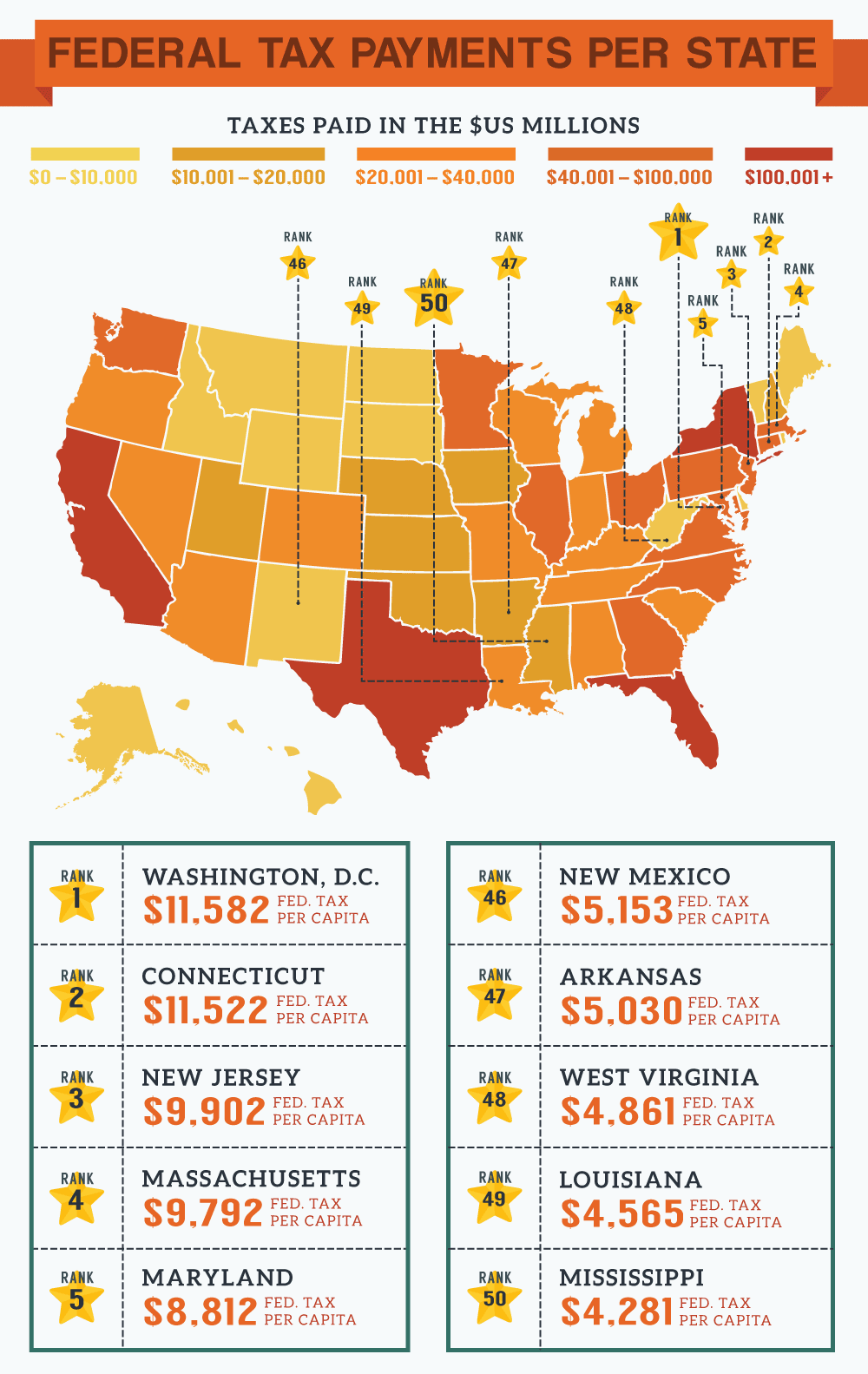

NEW YORK CNNMoney -- Residents in which states pay the most in taxes.

Federal tax dollars by state. 51 rows These states have paid to the federal government in taxes more than they receive back in. New Mexico is on top of the net taker states with a per capita surplus of 9693. Income in America is taxed by the federal government most state governments and many local governments.

The figures below are from the Massachusetts Taxpayers Foundation. That honor belongs to Mississippi at 5557. In fact according to HowMuch 40 out of 50 states actually receive more federal spending than they pay in federal taxes.

Federal collections in the state exceeded federal spending there by 213 billion. Many state pages also provide direct links to selected income tax return forms and other resources. New Jersey had the second-largest shortfall.

NEW YORK CNNMoney -- Residents in which states pay the most in taxes. FEDERAL TAXES PAID BY STATE. According to their report New York leads the nation in sending more taxpayer dollars to the federal government than it gets back in return followed by eight other states.

The other 42 states. Overview of Federal Taxes. FEDERAL TAXES PAID BY STATE in thousands 1.

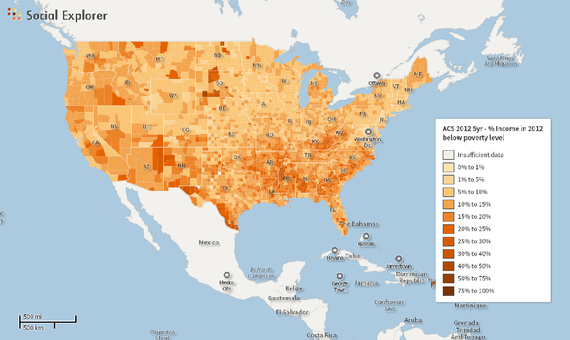

Our data come from the. 40 out of 50 states are getting more sometimes a lot more from the federal government than theyre paying in taxes. That year the states where federal aid made up the largest share of general revenue were Montana 461 percent Wyoming 445 percent Louisiana 437 percent Mississippi 433 percent and Arizona 431 percent.

Notably high-tax California was no longer on the list of donor states although just barely -- taxpayers there receive on average 12 more from the federal government than they pay out to it. In the 2017 fiscal year Montana the eighth-most dependent state overall in WalletHubs analysis received the highest amount of federal dollars for. Not surprisingly nine of the top ten states in federal taxes paid per capita are on the net payers list with Connecticut leading the way at 16052.

New Mexico paid 6182. Office of the State. If you want to compare all of the state tax rates on one page visit the list of state income taxes.

The Land of Enchantment received 257 for every dollar paid in federal taxes but its not because they pay the lowest federal taxes per capita. Choose any state from the list above for detailed state income tax information including 2021 income tax tables state tax deductions and state-specific income tax calculators. The money funneled to the federal government from New York mostly from income and payroll taxes was 356 billion greater in the 2017 federal fiscal year than federal spending in the state.

The figures below are from the Massachusetts Taxpayers Foundation. Several states in the Northeast pay thousands more in taxes than they receive from the federal government. The federal income tax system is progressive so the rate of taxation increases as income increases.

Tax dollars state by state See where your state ranks. Tax dollars state by state See where your state ranks. Taxpayers in Virginia receive more than 10000 on a per capita basis than they pay the biggest imbalance of any state in the country.

The few states where this isnt the case include Connecticut New Jersey and. For example Mississippi received 213 for every tax dollar it sends to Washington by way of federal taxes West Virginia 207 Kentucky 190 and South Carolina 171. For info on 2011 federal income tax and federal tax refunds visit the federal income tax and federal tax.

At the top of that list are Connecticut New Jersey Massachusetts and New York which all receive 83 cents in federal spending for every dollar they contribute.

United States Federal Tax Dollars Creditloan Com

United States Federal Tax Dollars Creditloan Com

Is Your State A Net Payer Or A Net Taker Moneytips

Is Your State A Net Payer Or A Net Taker Moneytips

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

Is Your State A Net Payer Or A Net Taker Moneytips

Is Your State A Net Payer Or A Net Taker Moneytips

United States Federal Tax Dollars Creditloan Com

United States Federal Tax Dollars Creditloan Com

Why Do Some States Feast On Federal Spending Not Others Tax Foundation

Why Do Some States Feast On Federal Spending Not Others Tax Foundation

Which States Rely The Most On Federal Aid Tax Foundation

Which States Rely The Most On Federal Aid Tax Foundation

Study Washington Is One Of 10 States That Send More Tax Dollars To D C Than They Receive In Federal Spending Opportunity Washington

Study Washington Is One Of 10 States That Send More Tax Dollars To D C Than They Receive In Federal Spending Opportunity Washington

Which States Pay The Most Federal Taxes Moneyrates

Which States Pay The Most Federal Taxes Moneyrates

18 Taxes Ideas Tax Federal Taxes Tax Rate

18 Taxes Ideas Tax Federal Taxes Tax Rate

Which States Are Givers And Which Are Takers The Atlantic

Which States Are Givers And Which Are Takers The Atlantic

Federal Spending Received Per Dollar Of Taxes Paid By State Fy2005 Metropolitan Transportation Commission

Federal Spending Received Per Dollar Of Taxes Paid By State Fy2005 Metropolitan Transportation Commission

Federal Expenditures By State Per Dollar Sent

Federal Expenditures By State Per Dollar Sent

Comments

Post a Comment