Conventional Loan Vs Fha Refinance

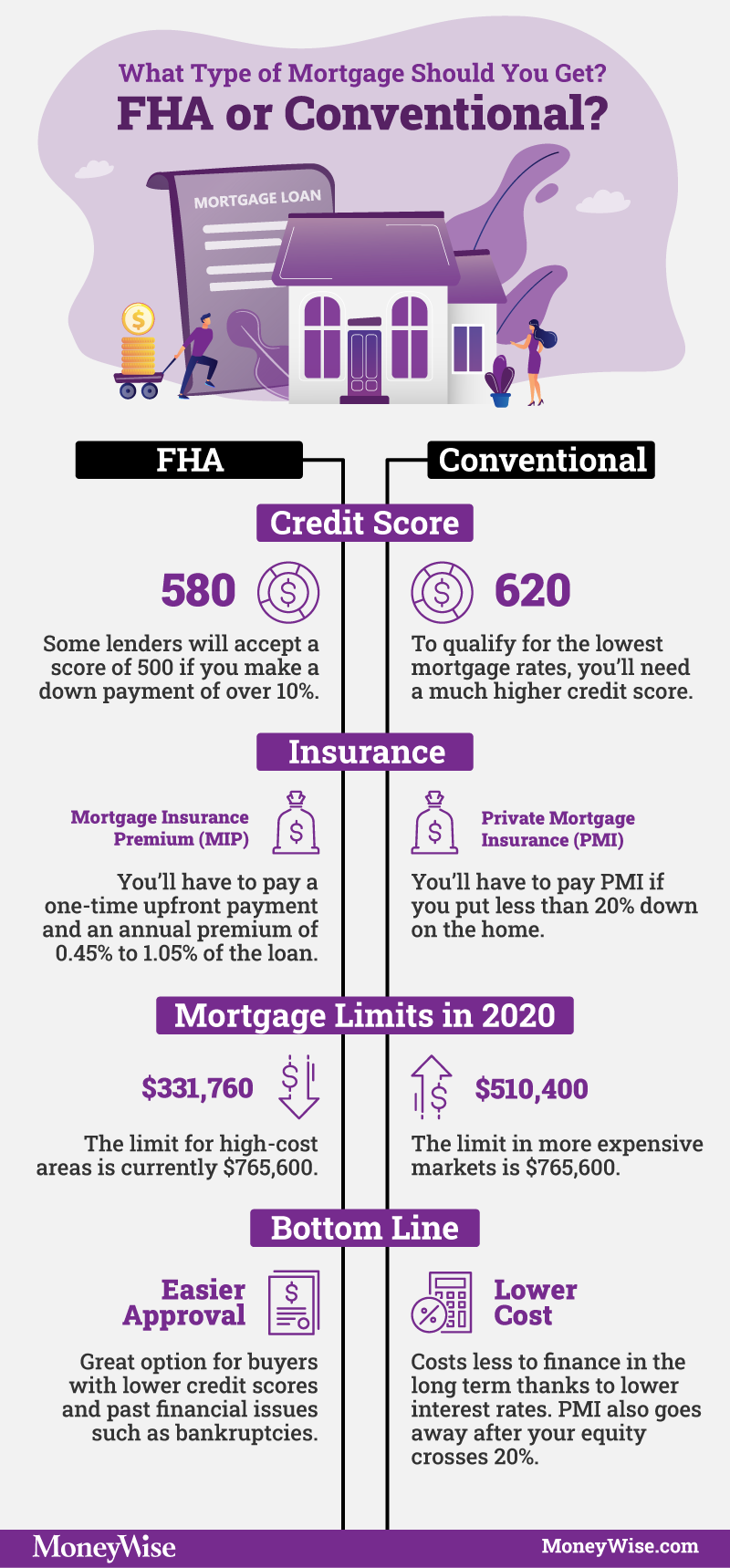

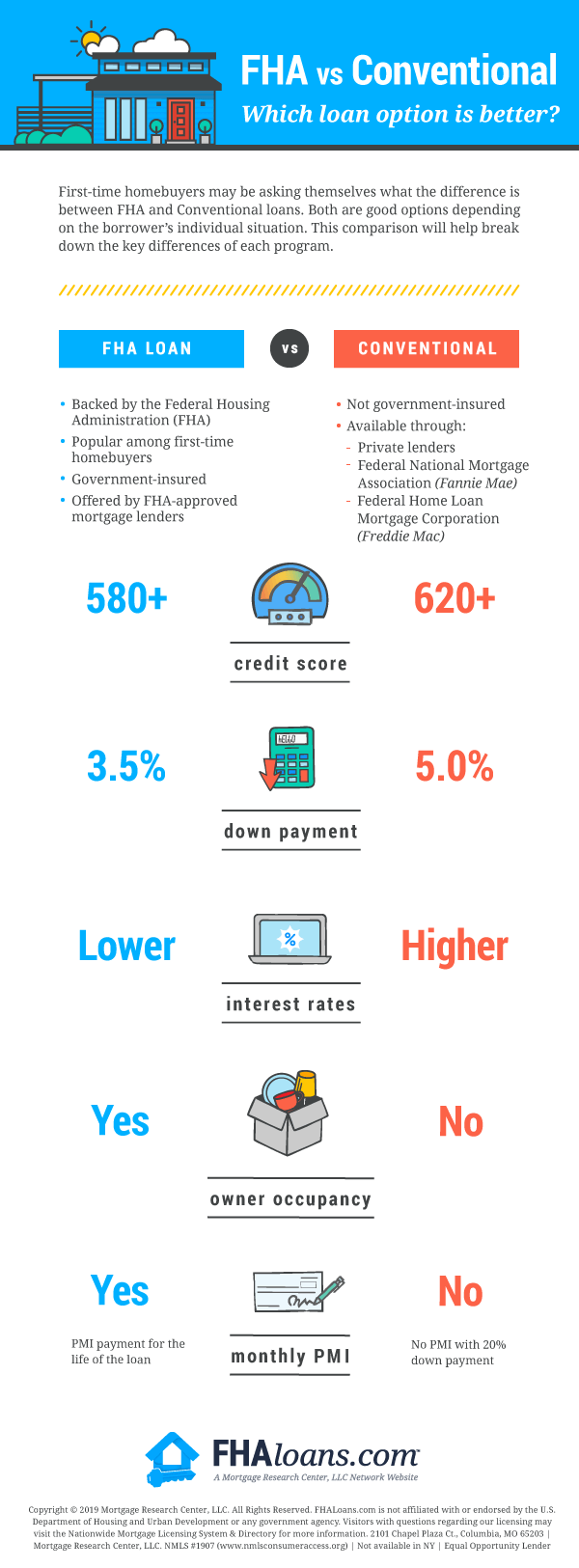

Its important to note that a conventional loan may be better in the long run as an FHA loan comes with some hefty interest fees to make up for its initial benefits. Conventional current mortgage rates are established in the same way as FHA refinance interest rates.

Fha Vs Conventional Loan How To Choose And Qualify In 2021

Fha Vs Conventional Loan How To Choose And Qualify In 2021

Are you wondering what is the difference between a Conventional Loan vs a FHA LoanIf so then this video is for youIn this video we cover.

Conventional loan vs fha refinance. As with FHA loans your current credit score affects your personal loan rate. Does it always make sense. Conventional Loan Vs Fha Refinance Apr 2021.

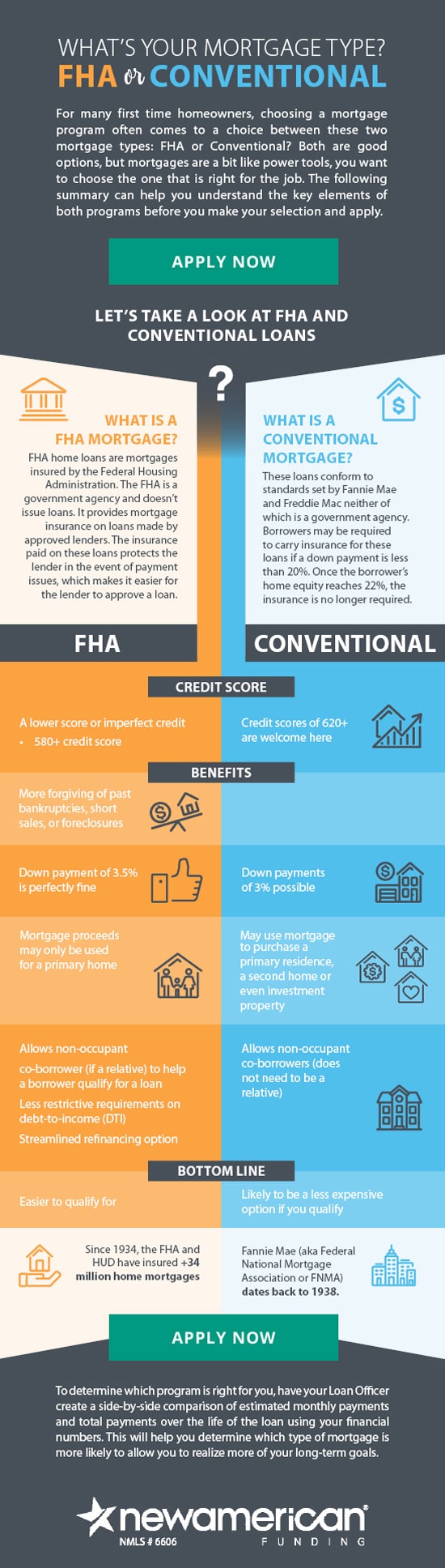

Refinance Fha Loan To Conventional - If you are looking for a way to reduce your expenses then our service can help you find a solution. Conventional Loan Vs Fha Loan Refinance Apr 2021. While FHA loans are easier and cheaper to qualify for than conventional loans they have lower mortgage insurance and allow borrowers to drop their PMI payment once the loan to value ratio reaches 78.

A conventional loan is supplied by a private lender and isnt federally insured. In this video Brian talks about refinancing from FHA to Conventional mortgage. If you do being with an FHA loan you may want to refinance to a loan that gives you better interest rates down the road.

Fha Streamline Refinance Conventional Loan Apr 2021. FHA loans are generally used to refinance or buy a home. Compared to an FHA loan conventional loans can be cheaper in the long run but they may be harder to qualify for.

Requirements for obtaining a conventional loan vary depending on the lender. If you refinance an FHA loan to a conventional loan you may be able to eliminate monthly mortgage insurance. Conventional loans dont require mortgage insurance if you have at least 20 equity in your home.

FHA loans are easier to qualify for because they require just a 580 credit score and a 35 down payment. As those interest rates rise mortgage rates often follow in the same direction. Conventional Vs Fha Cash Out Refinance Apr 2021.

Conventional Loan To Fha Refinance Apr 2021. Upfront mortgage insurance premium UFMIP and an. Fha Vs Conventional Refinance - If you are looking for a way to reduce your expenses then our service can help you find a solution.

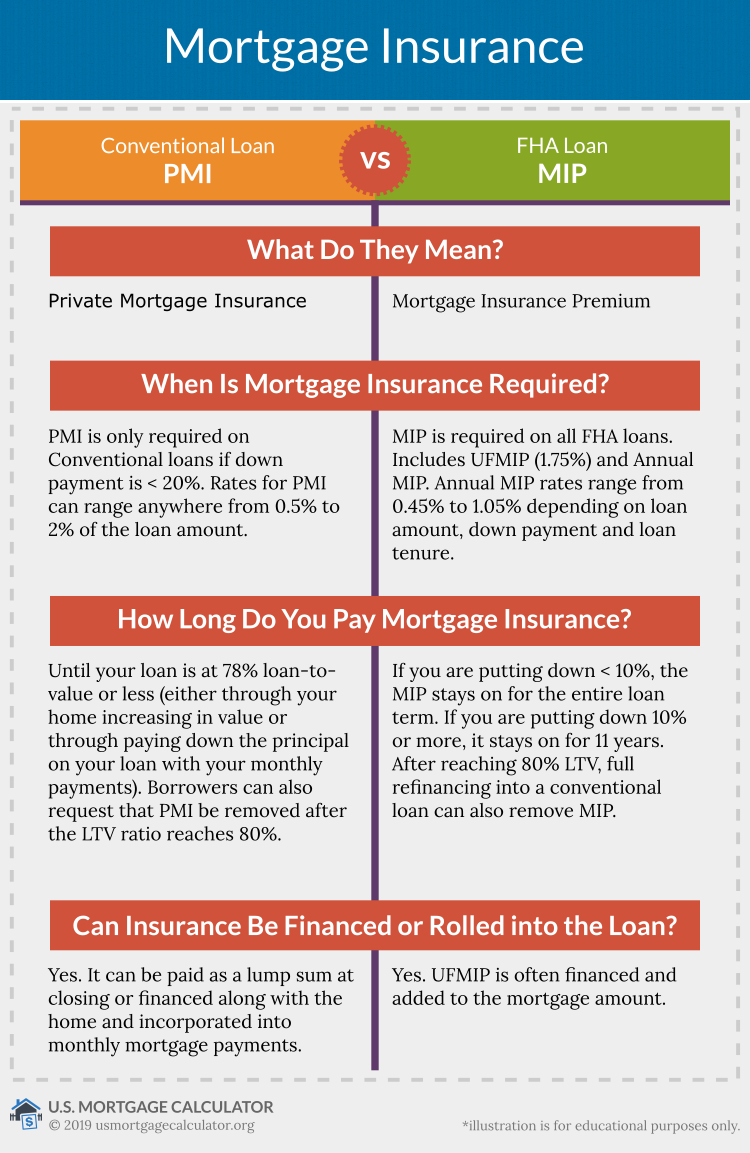

Mortgage insurance protects the lender. Conventional Loan Refinance To Fha Apr 2021. What are the benefits.

The Federal Reserve sets an initial rate on which banks base their interest rates. Many of these questions depe. Heres a breakdown of FHA vs conventional mortgage insurance.

FHA refinance loans require two types of mortgage insurance. What is an FH. Conventional lenders will allow a low down payment.

One of the drawbacks of FHA financing with a minimum down payment is having to pay monthly FHA mortgage insurance for the life of the loan. Refinance Fha To Conventional Loan - If you are looking for a way to reduce your expenses then our service can help you find a solution. What Is A Conventional Loan.

Fha Loan Vs Conventional Loan Key Differences New American Funding

Fha Loan Vs Conventional Loan Key Differences New American Funding

Fha Loans Vs Conventional Loans Pros And Cons Updated 2017

Fha Loans Vs Conventional Loans Pros And Cons Updated 2017

Private Mortgage Insurance Pmi Faq U S Mortgage Calculator

Private Mortgage Insurance Pmi Faq U S Mortgage Calculator

Fha Vs Conventional Loan Comparison Chart And Which Is Better

Fha Vs Conventional Loan Comparison Chart And Which Is Better

Fha Vs Conventional Which Low Down Payment Loan Is Best

Fha Vs Conventional Which Low Down Payment Loan Is Best

Difference Between Fha And Conventional Mortgage Your Mortgage Guy For Life

Fha Vs Conventional Loan Is There A Difference

Fha Vs Conventional Loan Is There A Difference

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Vs Conventional Loans How To Choose Updated For 2018 Total Mortgage Blog

Fha Vs Conventional Loans How To Choose Updated For 2018 Total Mortgage Blog

Which Is Better Fha Or Conventional Loan

Which Is Better Fha Or Conventional Loan

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortga Pay Off Mortgage Tip Conventional Mortgage Mortgage Marketing Mortgage Tips

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortga Pay Off Mortgage Tip Conventional Mortgage Mortgage Marketing Mortgage Tips

Comments

Post a Comment