Is Homeowners Insurance More Expensive On Older Homes

Insurers factor in the higher cost they. Standard homeowners policies provide coverage for disasters such as damage due to fire lightning hail and explosions.

Insurance Guide For Older Homes Coverage Com

Insurance Guide For Older Homes Coverage Com

Instead of juggling multiple policies and providers homeowners can simplify the process by working with a single provider for all insurance needs.

Is homeowners insurance more expensive on older homes. USAA insurance discounts for homeowners. They must also be made of reinforced concrete construction. Brick Veneer houses land in the middle of the pricing model.

Texas Kansas Oklahoma Florida Alabama and Mississippi have lots of tornadoes as well. Many were not built to meet todays building and safety standards. In the Midwest and West hail is.

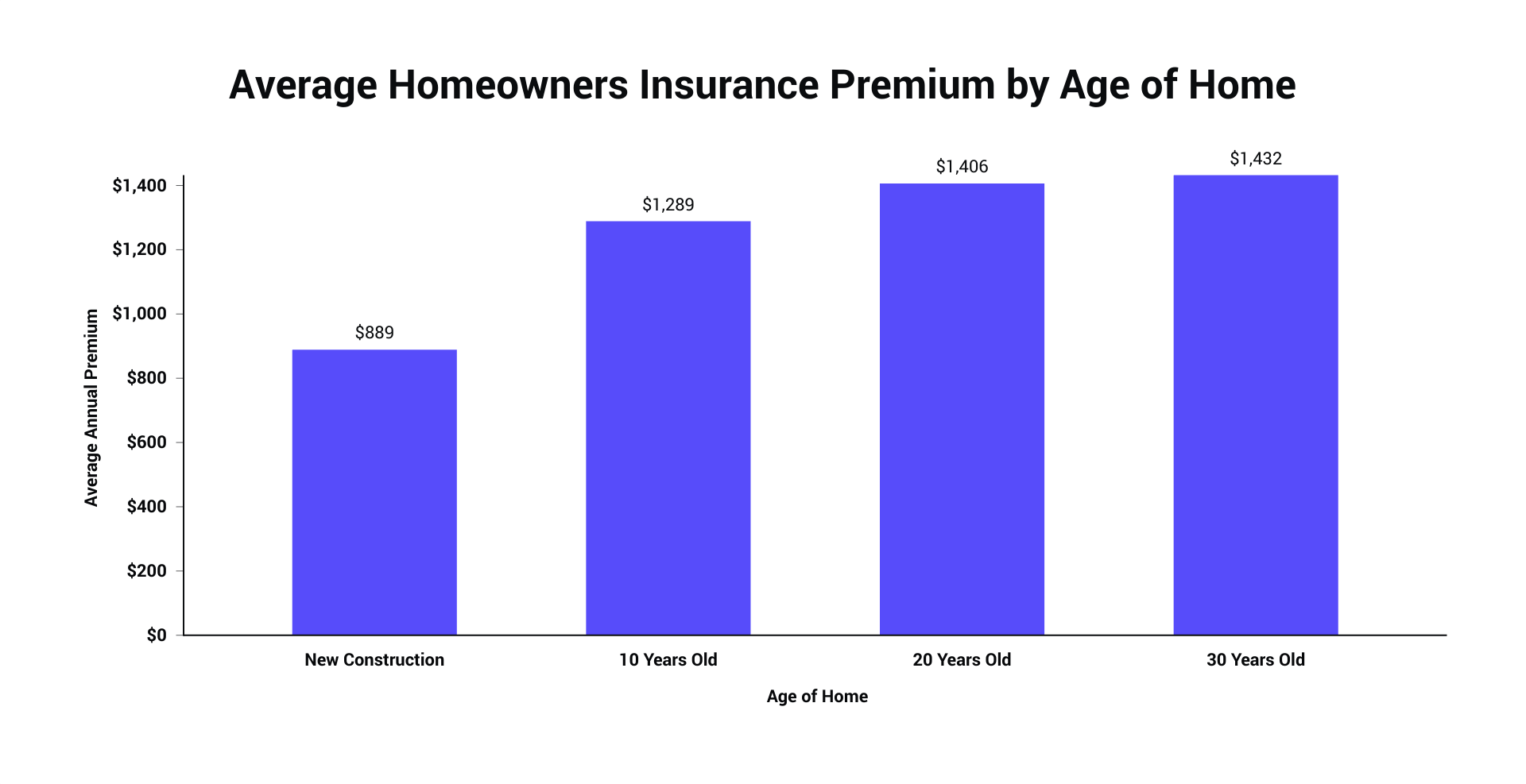

Old homes cost more to rebuild or repair so insurers mitigate their risks by charging higher rates. Is it more expensive to insure a 1970s concrete block ranch in original condition with 2000 square feet than a 2-story new construction block home built next door with 5000 square feet. New homes must meet the new Florida Building Code requirements.

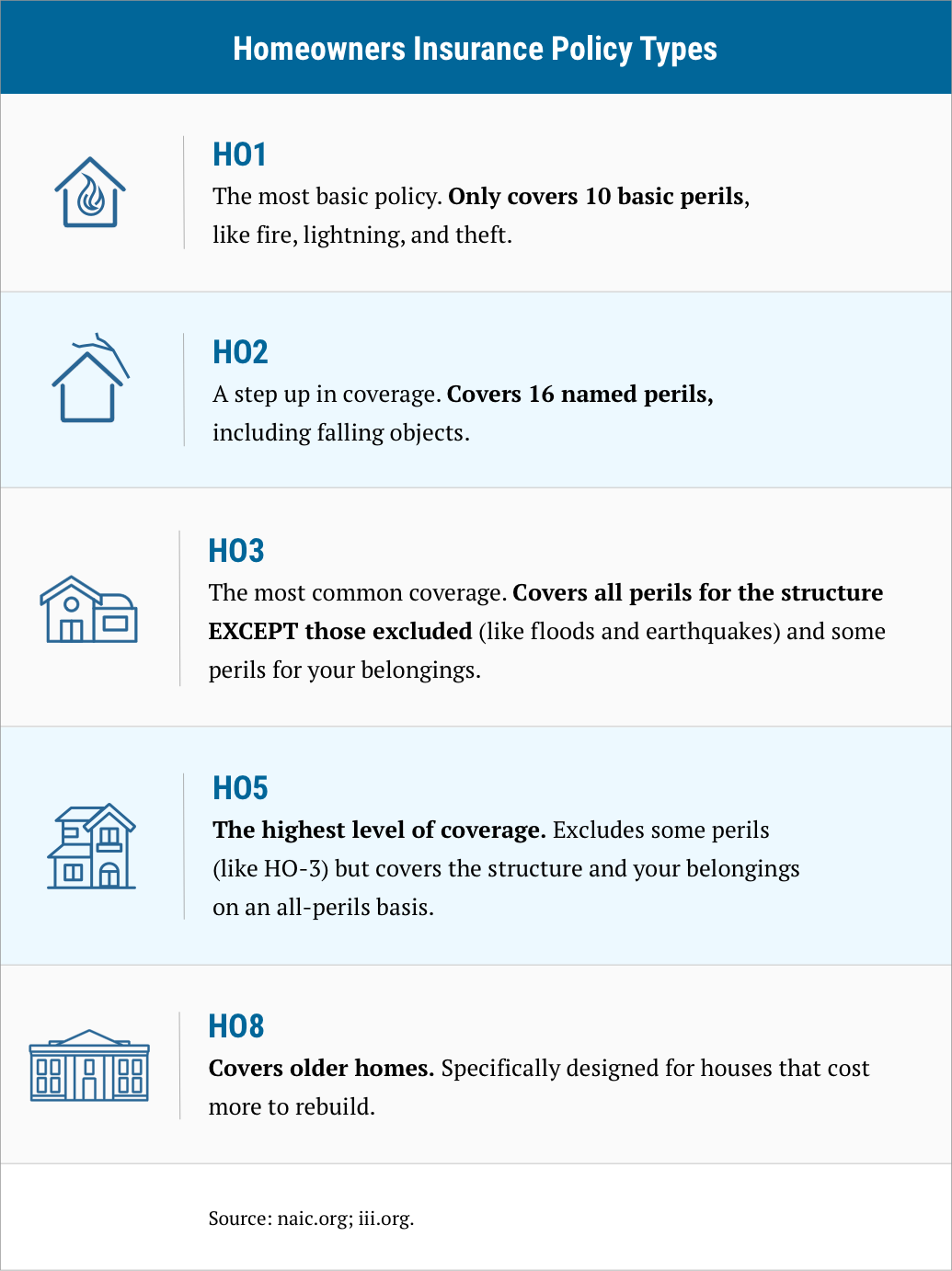

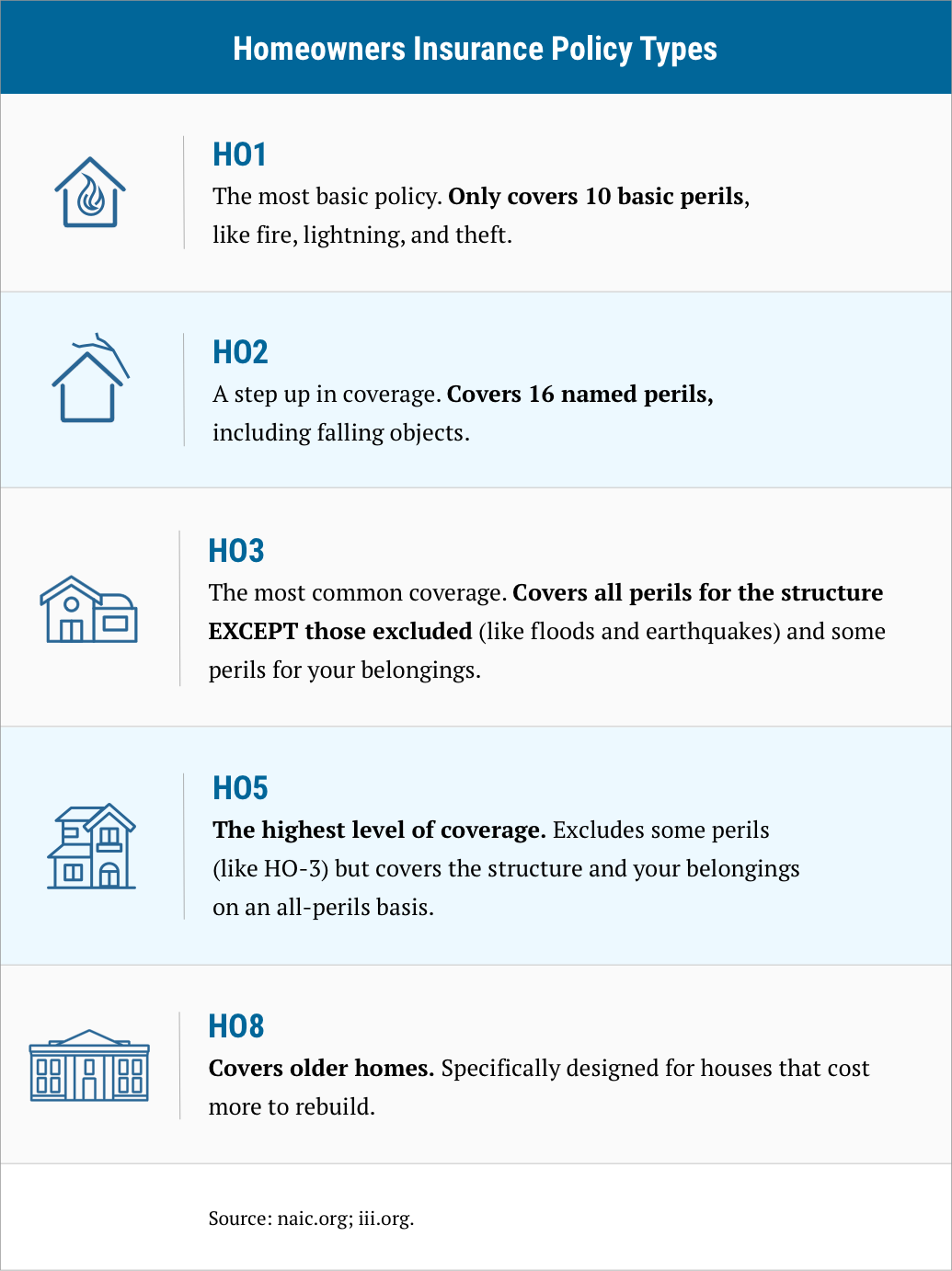

For instance home insurance can be more expensive in areas with a high risk of hurricanes or fires than in places where natural disasters are uncommon. Fire is the costliest source of claims for homeowners in this area. Insurance carriers offer several types of insurance for older homes including high-value homeowners policies HO-8 policies and HO-3 policies.

In every case youll want the limits on your policy to be high enough to cover the cost of. Some major home insurance companies DO NOT increase premiums based on breed including Allstate Amica Nationwide State Farm and USAA. And when repairs are needed replacement materials for 19th century houses are more expensive to source.

Higher home insurance premium for older properties reflect the higher cost of claims made by their owners. Its rates were only a few dollars more expensive than USAAs for our sample property in Texas. Newer homes often cost less to insure.

Age of Home - New homes are less expensive to insure than older homes. There were over 790 million in claims made against home owners for dog-related attacks in 2019. New flood requirements may require that homes be elevated so that the lowest living.

Many basements are finished as homeowners look for more living space and are used for recreational purposes often with expensive furnishings and equipment which make for more expensive claims. Therefore homes in coastal areas must have hurricane impact rated windows and doors. Pit bulls can increase home insurance premiums depending on the specific insurance company.

Youre more likely to need to make a claim for an older homes as the roofing plumbing and wiring are prone to wear out or develop faults. Youll likely need to upgrade your aluminum wiring to copper install new. Louisiana has the most expensive home insurance at an average of over 1980 a year and Oregon has the cheapest average home insurance at around 700 a year.

Acquiring insurance is an important aspect of homeownership. When purchasing more than a single policy with an insurance company homeowners dont just save money from bundling your insurance they enjoy far more convenience too. According to 2021 data the overall average annual premium for homeowners insurance is 1312 about 109 monthly based on a home.

If you buy an older home you can expect to pay a higher premium for homeowners insurance. Even people who love the character of an old house can be scared by the thought of keeping one thriving in the face of age weather and regular wear and tear. It also can pay off in extra savings and discounts.

My realtor friend claims the older home with have double the flood and homeowners premiums than the new home. The homeowners insurance rates by zip code varies due to certain reasons and natural calamities are one of them. Fast facts about pit bulls and home insurance.

The average cost of homeowners insurance is around 1250 a year but many factors play a role including the details of your property and which state and city you live in. As such having a finished basement could lead to an increase in your premium. Frame homes are more likely to be damaged by a fire or hurricane so insurance policies cost more for these properties.

However if you have an older home that has had updates to the roof plumbing heating and. Typically the rule is the older the home is the more expensive it is going to be to insure. In general they are more expensive to insure due to the repair and maintenance required.

Determine how much insurance you need for your homes structure. HO-8 homeowners insurance is designed for homes that dont meet the insurer standards required for most types of homeowners insurance. Those who live in areas where there is risk of flood or earthquake will need coverage for those disasters as well.

To understand how the cost of USAA homeowners insurance compared to other companies we collected sample quotes for homes at four different levels of coverage from USAA Allstate Liberty Mutual and State Farm. For example you may only be able to qualify for an HO-8 if you live in an older home at high-risk of loss due to aluminum wiring outdated plumbing or a roof thats falling apart. Is Insurance More Expensive For Older Homes.

In the South wind is the most common cause of home claims and hail is the most expensive. Although its true that having a finished basement could increase the premium its important you provide accurate. The most expensive ZIPs in Louisiana Mississippi Alabama Texas South Carolina and Massachusetts are all coastal areas prone to catastrophic storms that are costly to insurers who then pass that cost to homeowners.

Homeowners Insurance For An Older Home

Homeowners Insurance For An Older Home

Homeowners Insurance For Older Homes Insurance Com

Homeowners Insurance For Older Homes Insurance Com

Average Cost Of Homeowners Insurance 2021 Valuepenguin

Homeowners Insurance For Older Homes

Homeowners Insurance For Older Homes

Homeowners Insurance For Older Homes Allstate

Homeowners Insurance For Older Homes Allstate

The Cost Of Insuring An Old House Which News

The Cost Of Insuring An Old House Which News

15 Home Insurance Myths You Should Stop Believing Now

15 Home Insurance Myths You Should Stop Believing Now

The Complete Guide To Home Insurance The Simple Dollar

The Complete Guide To Home Insurance The Simple Dollar

Insurance Guide For Older Homes Coverage Com

Insurance Guide For Older Homes Coverage Com

Average Cost Of Homeowners Insurance 2021 Valuepenguin

5 Best Homeowners Insurance Companies Of 2021 Money

5 Best Homeowners Insurance Companies Of 2021 Money

/buying-newer-or-older-home-1798298-V5-2b655f15985647dcb9d16dd7bf55e947.png) Buying New Homes Or Older Homes

Buying New Homes Or Older Homes

Home Insurance For Older Homes The Zebra

Home Insurance For Older Homes The Zebra

Comments

Post a Comment