What Does It Mean To Be Head Of Household

It does equate with the responsibility party. In order to file as head of household you must provide at least 50 of the care received by a dependent such as a child parent brother sister step-parent step-sibling foster child.

What Does It Mean To Be Head Of Household Simplify Complexity

Pay for more than half of the household expenses.

What does it mean to be head of household. It was disregard for divinely constituted authority that resulted in mans often brutal domination of women. The head of household status can lead to a lower taxable income and greater potential refund than the single filing status but to qualify you must meet certain criteria. You paid more than half the cost of keeping up a home for the year.

You are unmarried recently divorced or legally separated from a spouse. In some cases this is a result of cultural changes. And He is the Savior of the body.

Biblical headship is a loving arrangement and is by no means synonymous with tyranny. This is usually the working adult who has the greatest income. Youre unmarried or considered unmarried on the last day of 2020.

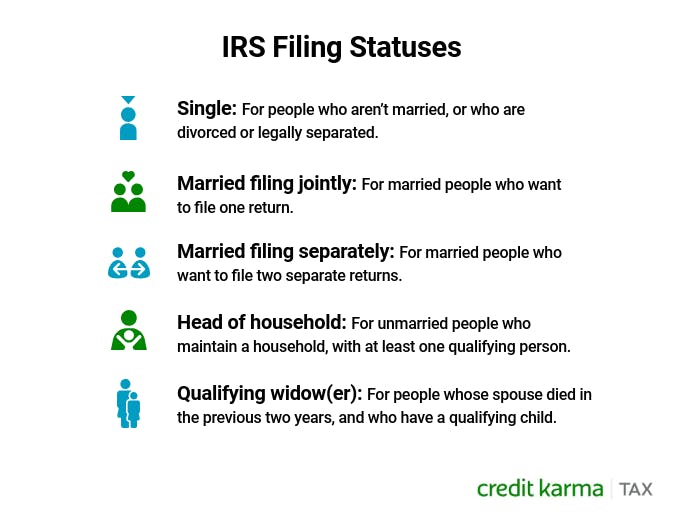

Head of household is a filing status the IRS uses to determine what tax bracket tax credits and responsibilities apply to you during the course of a tax year. Headship of husbands is a controversial issue. Whether a husband is saved or unsaved lazy or diligent active or passive God appointed the husband as the head of the home.

The head of a household is responsible before God for the spiritual and emotional well-being of the family. A qualifying person lived with you in. Eli knew about their evil actions but did nothing about it so God held Eli responsible as the head of the household 1 Samuel 313.

Head of household is a filing status on tax returns filed by unmarried taxpayers who support and house a qualifying person. He spends his days working to support his family. Youre not married on the last day of the year.

This filing status provides a larger standard deduction and more generous tax rates. He manages the homes finances takes care of the necessary repairs and provides a supportive. I dont believe head of house equates with boss.

To qualify as head of household youll need to meet certain criteria. You must pay more than You must pay more than half the cost of keeping up a home that was the main home for the entire year for your parent. There are some who take offense to the idea that the man is to be the leader of the family.

It encompasses a duty to responsibility and to delegating responsibility. Be considered unmarried for the tax year and. For the husband is head of the wife as also Christ is head of the church.

You must have a qualifying child or dependent. Genesis 316 Since the garden of Eden men have frequently abused their power viciously exploiting others including women and children. Beyond the IRS the term has come to mean generally the person in charge in the house.

Answer You may still qualify for head of household filing status even though you arent entitled to claim your child as a dependent if you meet the following requirements. By the IRS definition the head of household is the individual in the house who has paid more than half of the expenses of the home during the 12-month calendar year. In answer to the original question though.

There are three key requirements to qualify as a head of household. Youre not married or youre considered unmarried on the last day of the year. Head of household is a filing status for single or unmarried taxpayers who have maintained a home for a qualifying person such as a child or relative.

God judged Eli for not restraining his wicked sons. You might be able to claim head of household HOH filing status if you meet these requirements. Head of household is a Christian term that applies to the leadership role a husband is given within a marriage.

What does it mean for a man to be head of the household. 6 You are eligible to file as head of household even if your parent whom you can claim as a dependent doesnt live with you. Therefore just as the church is subject to Christ so let the wives be to their own husbands in everything.

It includes the duties to lead to guide to manage to protect to provide for. Where does that even come from. To file as head of household you must.

A head receives 51 percent of the vote. For the purposes of the Head of Household filing status a qualifying person is a child parent or relative who meets certain conditions listed below. The Husband as Head of Household In many marriages even in todays society the husband is the head of the household.

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

What Does Head Of Household Mean Here S How It Will Impact Your Taxes Filing Taxes Tax Household

What Does Head Of Household Mean Here S How It Will Impact Your Taxes Filing Taxes Tax Household

What Does Filing As Head Of Household Mean For Your Taxes

What Does Filing As Head Of Household Mean For Your Taxes

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Head Of Household Definition Filing Requirements And Advantages

Head Of Household Definition Filing Requirements And Advantages

What Does Head Of Household Mean How To Choose Your Status

What Does Head Of Household Mean How To Choose Your Status

Dentrix Tip Tuesdays What Does Head Of Household Mean In Dentrix

Dentrix Tip Tuesdays What Does Head Of Household Mean In Dentrix

What Does Head Of Household Mean It Could Mean Great Things For Your Taxes

What Does Head Of Household Mean It Could Mean Great Things For Your Taxes

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

Filing As Head Of Household What To Know Credit Karma Tax

Filing As Head Of Household What To Know Credit Karma Tax

/taxesfeb15013-5bfc2ce046e0fb005119e979.jpg) What Does Filing As Head Of Household Mean For Your Taxes

What Does Filing As Head Of Household Mean For Your Taxes

What Does Head Of Household Really Mean Youtube

What Does Head Of Household Really Mean Youtube

What Are The Head Of Household Requirements Howstuffworks

What Are The Head Of Household Requirements Howstuffworks

Head Of Household Does It Still Mean What It Used To Blackandmarriedwithkids Com

Head Of Household Does It Still Mean What It Used To Blackandmarriedwithkids Com

Comments

Post a Comment